Wills and Trusts

At C&L, we focus on protecting families

Why Choose us?

Trust, Will and Estate Attorneys Knoxville TN

At C&L, we focus on protecting families from the expense and delay of probate, explaining long-term care planning options and minimizing tax consequences, both during lifetime and upon death. We also implement the basic and advanced estate planning strategies our clients need – and we assist in administering clients’ estates upon death or disability. Because the majority of the work our firm does relates to Trusts and Estates, our focused practice allows us to answer the complex questions and concerns you have about estate planning.

Since 1989, the aim of our law firm is to help you, our client, understand the basic principles of estate planning, its importance and why each individual needs a plan. We have helped thousands of individuals secure their assets and eased their minds – and helped the families left behind. By taking advantage of the services that C&L has to offer, you can be assured that your legacy and your family will be protected.

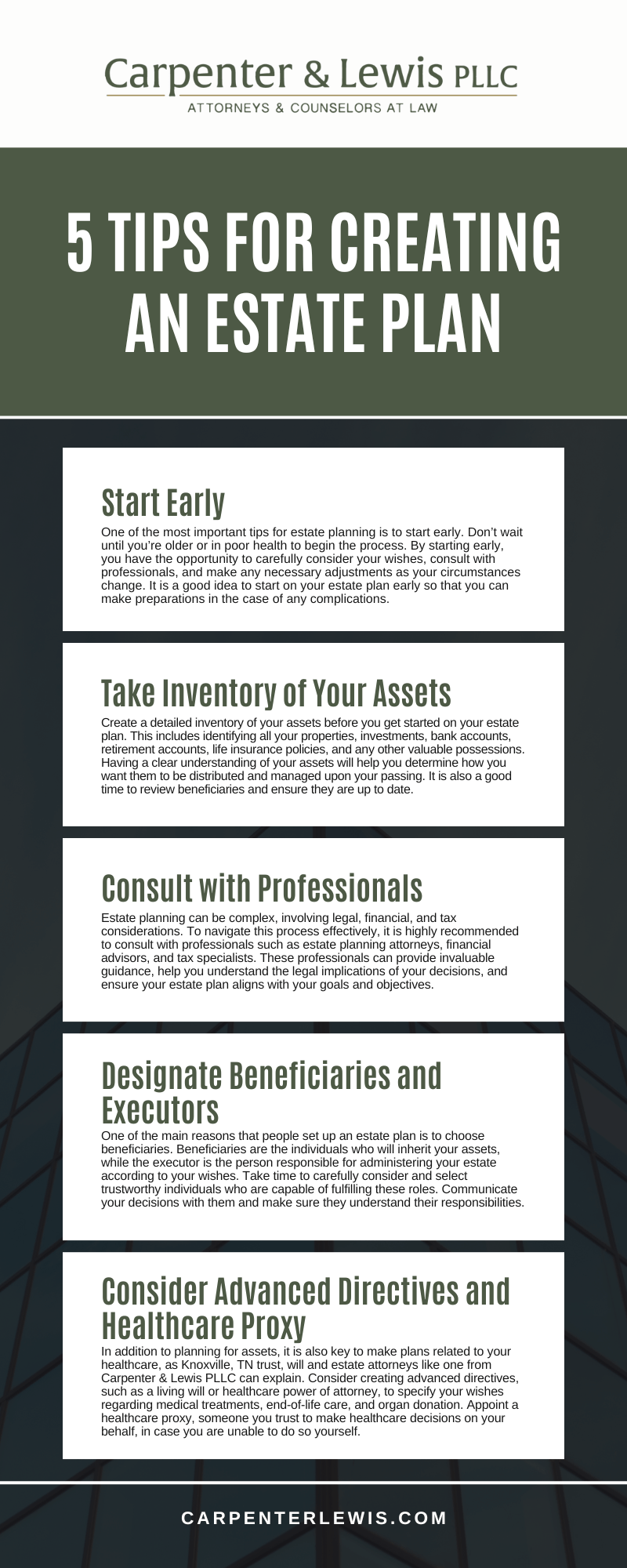

5 Tips for Creating an Estate Plan

Creating an estate plan is a crucial step in ensuring your wishes are followed and your assets are protected after your passing, as Knoxville, TN trust, will and estate attorneys can explain. By taking the time to plan ahead, you can provide clarity and peace of mind to your loved ones during a difficult time.

Start Early

One of the most important tips for estate planning is to start early. Don’t wait until you’re older or in poor health to begin the process. By starting early, you have the opportunity to carefully consider your wishes, consult with professionals, and make any necessary adjustments as your circumstances change. It is a good idea to start on your estate plan early so that you can make preparations in the case of any complications.

Take Inventory of Your Assets

Create a detailed inventory of your assets before you get started on your estate plan. This includes identifying all your properties, investments, bank accounts, retirement accounts, life insurance policies, and any other valuable possessions. Having a clear understanding of your assets will help you determine how you want them to be distributed and managed upon your passing. It is also a good time to review beneficiaries and ensure they are up to date.

Consult with Professionals

Estate planning can be complex, involving legal, financial, and tax considerations. To navigate this process effectively, it is highly recommended to consult with professionals such as estate planning attorneys, financial advisors, and tax specialists. These professionals can provide invaluable guidance, help you understand the legal implications of your decisions, and ensure your estate plan aligns with your goals and objectives. Their knowledge will ensure that your plan is specific to you and reflects your particular goals.

Designate Beneficiaries and Executors

One of the main reasons that people set up an estate plan is to choose beneficiaries. Beneficiaries are the individuals who will inherit your assets, while the executor is the person responsible for administering your estate according to your wishes. Take time to carefully consider and select trustworthy individuals who are capable of fulfilling these roles. Communicate your decisions with them and make sure they understand their responsibilities. Regularly review and update these designations as necessary to reflect any changes in your personal circumstances or relationships.

Consider Advanced Directives and Healthcare Proxy

In addition to planning for assets, it is also key to make plans related to your healthcare, as Knoxville, TN trust, will and estate attorneys like one from Carpenter & Lewis PLLC can explain. Consider creating advanced directives, such as a living will or healthcare power of attorney, to specify your wishes regarding medical treatments, end-of-life care, and organ donation. Appoint a healthcare proxy, someone you trust to make healthcare decisions on your behalf, in case you are unable to do so yourself. These documents provide clarity and guidance to your loved ones and healthcare professionals during challenging times.

Creating an estate plan is a vital step in ensuring your assets are protected and your wishes are carried out. By starting early, taking inventory of your assets, consulting with professionals, designating beneficiaries and executors, and considering advanced directives, you can create a comprehensive estate plan tailored to your specific needs. Remember to regularly review and update your estate plan to reflect any changes in your life circumstances. Contact skilled Knoxville, TN trust, will and estate attorneys so that you can receive personalized legal counsel when you are preparing an estate plan.

Knoxville Trust, Will And Estate Infographic

Some of our attorneys have been rated highly by independent organizations in the legal community:

10 Reasons To Ask Your Knoxville, TN, Trust, Will And Estate Attorneys About A Living Trust

Creating a living trust is a strategic way to manage and protect your assets during your lifetime and ensure they are distributed according to your wishes after your death. Here are ten benefits of setting up a living trust with the help of Knoxville, TN, trust, will, and estate attorneys:

- Avoiding Probate

One of the most significant advantages of a living trust is that it helps your estate avoid the probate process. Probate can be lengthy and costly, delaying the distribution of assets to your beneficiaries. A living trust allows for the seamless transfer of assets, bypassing probate court.

- Maintaining Privacy

Probate proceedings are public, meaning anyone can access the details of your estate. A living trust, however, is a private document. This ensures that the details of your assets, beneficiaries, and the distribution of your estate remain confidential.

- Managing Incapacity

A living trust includes provisions for managing your assets if you become incapacitated. Your designated successor trustee can manage your affairs without needing court-appointed guardianship. Your finances are handled according to your instructions.

- Flexibility and Control

A living trust offers flexibility, allowing you to retain control over your assets during your lifetime. You can amend or revoke the trust as your circumstances change. This adaptability ensures that your estate plan aligns with your current wishes and financial situation.

- Efficient Distribution of Assets

With a living trust, your assets can be distributed to your beneficiaries quickly and efficiently after your death. This is particularly beneficial if you have minor children or beneficiaries who may need immediate access to funds for their care and support.

- Protecting Beneficiaries

A living trust can protect beneficiaries who are minors, have special needs, or may not be financially responsible. You can set conditions for distributions, such as reaching a certain age or achieving specific milestones.

- Reducing Estate Taxes

Your estate attorney can help structure the trust to take advantage of tax-saving opportunities, ensuring more of your assets go to your beneficiaries rather than the government.

- Protecting Assets from Creditors

Setting up specific provisions within the trust can help shield your assets from being seized to satisfy debts, ensuring that your beneficiaries receive their intended inheritance.

- Facilitating Business Continuity

If you own a business, a living trust can provide for its smooth transition upon your incapacity or death. You can designate a successor trustee to manage or transfer the business according to your wishes, ensuring its continued operation and protecting its value.

- Customizing Your Estate Plan

Working with an estate attorney allows you to tailor the living trust to your specific needs and goals. Your attorney can help you draft detailed instructions, address unique family dynamics, and incorporate charitable giving, ensuring that your estate plan reflects your personal values and priorities.

Create A Living Trust With The Help Of A Knoxville Trust, Will, And Estate Attorney

Creating a living trust with the assistance of an estate attorney offers numerous benefits, from avoiding probate and maintaining privacy to protecting beneficiaries and ensuring efficient asset distribution. The legal team at Carpenter & Lewis PLLC gets to know you and your goals to structure a living trust to help you achieve them.

Lawyer Stephen Carpenter | Featured Attorney Estate Planning

Request A Consultation

Client Review

“We own several businesses and have had the pleasure of working with Stephen and his team for over 9 years now. He always comes through in a pinch. They have assisted us with leases, estate planning, company formations and even landlord issues. I highly recommend them for all your business attorney needs!”

Mary Ellen Nichols

For Over 30 Years

Advising our clients and drafting quality estate planning documents that are thorough and custom to our clients needs and desires.

Helping our clients protect their assets for those they love has been our goal from the very beginning.

We are recognized throughout East Tennessee for our experience in educating individuals about the importance of proper estate planning.

Estate Planning - Frequently Asked Questions (and Answers!)

Your “Estate” is a legal term that generally refers to the personal items, accounts, other assets and property that you individually own and leave behind at the time of your death.

Some people feel that “estate planning” relates only to large estates trying to reduce taxes, but it is much more than just avoiding tax. Estate planning is an important process of evaluating your needs, who will make decisions for you if you are incapacitated, and how best to pass your assets to your family after you have died. In short, estate planning involves thinking about the future and obtaining expert advice and counsel on how to achieve your wishes.

We work alongside accountants, financial planners, and similar advisors to assist you with your estate plan. We offer independent legal advice and counsel, in addition to the drafting of the legal documents necessary to implement the decisions you have made.

Estate planning is done largely for your family, but it does benefit you by giving you peace of mind, knowing that you have taken care of your family’s future in the event of your death or disability. When done properly, you can avoid undue hassle in settling your estate and avoid costs on the transfer of your assets.

A Will is a legal document that governs the distribution of your assets at death, naming one or more persons to manage your estate and providing for the distribution of all property at death. There is no legal requirement that a will be prepared by a lawyer, although there are pitfalls for home-made wills, such as not properly witnessing it or including unclear language that requires a judge to interpret your intentions.

Unfortunately, more than half of all adults don’t make use of this essential estate planning tool. It’s especially important to have a Will (or consider revising an existing Will) when you get married, have children, accumulate sizable assets, or experience any significant change in your financial or personal circumstances.

If you die without a Will, in legal terminology, you are “intestate,” which means your estate is then distributed according to the intestate laws of the state in which your property is located. These laws typically favor the surviving spouse, though he or she won’t necessarily receive the entire estate. In any case, the distribution of your assets has been taken out of your hands, and there is no guarantee that the results will reflect your wishes. More importantly, if you have minor children, the probate court will have jurisdiction over your children and who takes care of them and any assets that pass to them until they reach age 18.

A Trust is a legal arrangement in which a party (called a trustee) holds legal title to property for the benefit of one or more beneficiaries. Rather than hold on to assets that you intend to be for the eventual benefit of others, you transfer ownership to a trust, a legal entity established by you and controlled by the trustee. In most circumstances, you will serve as trustee – and thereby keep full control over your assets during your lifetime.

Everything you currently own and control can be placed in such a Trust through which you continue to own and control it, but with the benefits described herein. Assets previously owned by John Smith could, for instance, now belong to “John Smith, Trustee of the John Smith Living Trust, under Declaration of Trust, dated January 1, 2021.” You can still sell property in your Trust, transfer assets into and out of the Trust, and even revoke the Trust. Nothing has changed except the title of ownership attached to your property.

A growing number of people are choosing Trusts to add a level of convenience for their family. A Trust avoids probate and allows heirs to receive from the estate immediately, without the four (4) month delay imposed by Tennessee probate laws to pass property under a Will. A Trust especially makes sense if you own real property in another state. A vacation home in another state, for example, can be kept out of that state’s probate courts with a Living Trust.

A Trust can serve a number of goals. You might arrange for your spouse to receive investment income from the Trust, with the principal to be distributed to your children after the death of your spouse. Or you might stipulate the circumstances under which assets are to be distributed to your beneficiaries. You can demand, for example, that your children finish college before digging into the Trust fund’s principal.

You can also establish a Trust to provide for the support of a family member with special needs, such as a disability that prevents him or her from working. Some people establish Trusts simply to maintain their estate’s privacy. Unlike a Will, a Trust is not a public document. The added privacy and ease of transfer that results from avoiding probate is the primary reason so many people are using Trusts today. Another significant benefit of a trust in Tennessee for married couples is that capital gains tax on the first spouse to die can be eliminated with a Community Property Trust.

Unlike a Will, a Power of Attorney operates during your lifetime. It can become operative immediately or upon your inability to act for yourself. If you become seriously ill, you need someone you trust to be able to handle your financial affairs (pay bills and handle investments for you). A Durable Power of Attorney is designed to allow a relative or friend (your “agent”) to act on your behalf in the circumstances you set out in the document.

Another document you should consider is a Healthcare Power of Attorney, which names a person to make medical decisions for you if you are unable to act for yourself (in a coma, for example). It allows that person to handle your medical affairs for you.

An “advance directive” (typically confusingly called a “Living Will” in Tennessee) can be executed if you wish to direct what limitations you prefer to impose on your doctor to artificially keep you alive if you become terminally ill. This is a serious matter to consider. For example, many clients express that they do not want artificial life support if they have no hope of recovery and the machine is just prolonging the inevitable.

Yes, a will, power of attorney for financial, power of attorney for healthcare, and living will are all documents that everyone needs and that should always be included in a complete estate plan. They allow you to communicate your decisions to your family, which is vitally important should the need arise. A trust is optional but having a trust could be beneficial depending on your family and financial circumstances.

Carpenter & Lewis routinely assists clients in Knoxville and throughout East Tennessee with their estate planning. Our attorneys can help you with a plan tailored to your situation so that you can have peace of mind for the future.

Client Review

“We own several businesses and have had the pleasure of working with Stephen and his team for over 9 years now. He always comes through in a pinch. They have assisted us with leases, estate planning, company formations and even landlord issues. I highly recommend them for all your business attorney needs!”

Mary Ellen Nichols

Checkout our latest ideas

Press & Media

Schedule Your Appointment

10413 Kingston Pike, Suite 200

Knoxville, Tennessee 37922

New Clients: (865) 509-9600

Existing Clients: (865) 690-4997

Facsimile: (865) 690-4790

10413 Kingston Pike, Suite 200 Knoxville, Tennessee 37922

Also Serving: Farragut TN

New Clients: (865) 509-9600

Existing Clients: (865) 690-4997

Facsimile: (865) 690-4790

Estate Planning Lawyer Knoxville TN | Wills Lawyer Knoxville TN | Probate Lawyer Knoxville TN | Elder Law Lawyer Knoxville TN | Estate Settlement Attorney Knoxville TN | Wills Lawyer Farragut TN | Trust Lawyer Farragut TN | Probate Lawyer Farragut TN | Estate Planning Lawyer Maryville TN | Probate Lawyer Maryville TN | Wills Lawyer Maryville TN | Elder Law Lawyer Maryville TN | Trust Lawyer Maryville TN