Probate and Estates

Probate & Estate Administration

estate administrators may have a free consultation.

Why Choose us?

Probate and Estate Attorneys Knoxville TN

After the loss of a loved one, you need competent probate attorneys to guide you through the complexity of the probate and estate administration process. Our probate and trust administration practice is focused on helping families through this difficult time, while simplifying the legal complexities that they are confronted with. We recognize that probate and estate administration can be an emotional, difficult and complicated process. Our firm provides the counsel needed to complete the process in a timely and efficient manner and makes certain that clients are fully informed and guided through each step of the process. We advise and represent beneficiaries, executors, administrators, personal representatives, trustees, heirs and interested parties in regard to probate and trust administration matters.

Our firm has decades of experience in handling probate estates for clients. We recognize both the difficult emotional time it often is for clients and also the need to walk clients comfortably through the probate process in a fair and cost-effective manner. Let us help you.

Consulting with a Knoxville, TN estate and probate attorneys is important for a variety of reasons. From protecting your assets and ensuring a smooth transition of your estate to minimizing taxes and planning for incapacity, their expertise can help you navigate the complexities of estate planning and administration.

Protect Your Assets and Legacy

One of the primary reasons to engage an estate lawyer is to protect your hard-earned assets and ensure your legacy is preserved according to your wishes. Estate planning involves creating a comprehensive plan that includes a will, trusts, and other legal documents to outline how your assets should be distributed upon your death. You can depend on a skilled Knoxville probate and trust lawyer like one from Carpenter & Lewis PLLC to guide you through the complexities of estate planning and how you can best protect your assets.

Ensure the Smooth Transition of Your Estate

If you want your estate to undergo a successful transition, it is helpful to have a lawyer. They can assist in drafting a clear and legally binding will that outlines your specific wishes regarding the distribution of your assets. Without a well-drafted will, the distribution process can become chaotic and contentious among your loved ones. By working with an estate lawyer, you can avoid disputes and potential legal challenges that may arise after your passing.

Minimize Estate Taxes

If you have to avoid unnecessary costs and ensure your beneficiaries can receive a large amount of assets, you must get your taxes in order. An estate lawyer can help you navigate the complex tax laws and develop strategies to minimize estate taxes. They can guide you through various options such as establishing trusts, making charitable contributions, and utilizing exemptions and deductions. By employing these tactics, an estate lawyer can help protect your estate from unnecessary tax burdens.

Plan for Incapacity

When you are making an estate plan, you should also consider your medical needs in addition to your financial matters. It also encompasses planning for potential incapacity due to illness, disability, or old age. An estate lawyer can assist you in establishing a power of attorney and a healthcare proxy, which will grant someone you trust the authority to make financial and medical decisions on your behalf if you become incapacitated. By having these documents in place, you can ensure that your wishes are respected and your affairs are handled according to your instructions.

Navigate Complex Legal Procedures

Estate planning law can be confusing and overwhelming to understand. An estate lawyer can provide invaluable guidance and support during this challenging process. They have a deep understanding of the legal requirements, documentation, and deadlines involved in probate, estate administration, and trust management. By working with an estate lawyer, you can have peace of mind knowing that all the necessary legal procedures will be handled efficiently and accurately.

By seeking their professional advice, you can secure your legacy, protect your loved ones, and gain peace of mind knowing that your affairs are in order. Connect with Knoxville, TN estate and probate attorneys now so that you can receive legal assistance with your estate planning matters.

Some of our attorneys have been rated highly by independent organizations in the legal community:

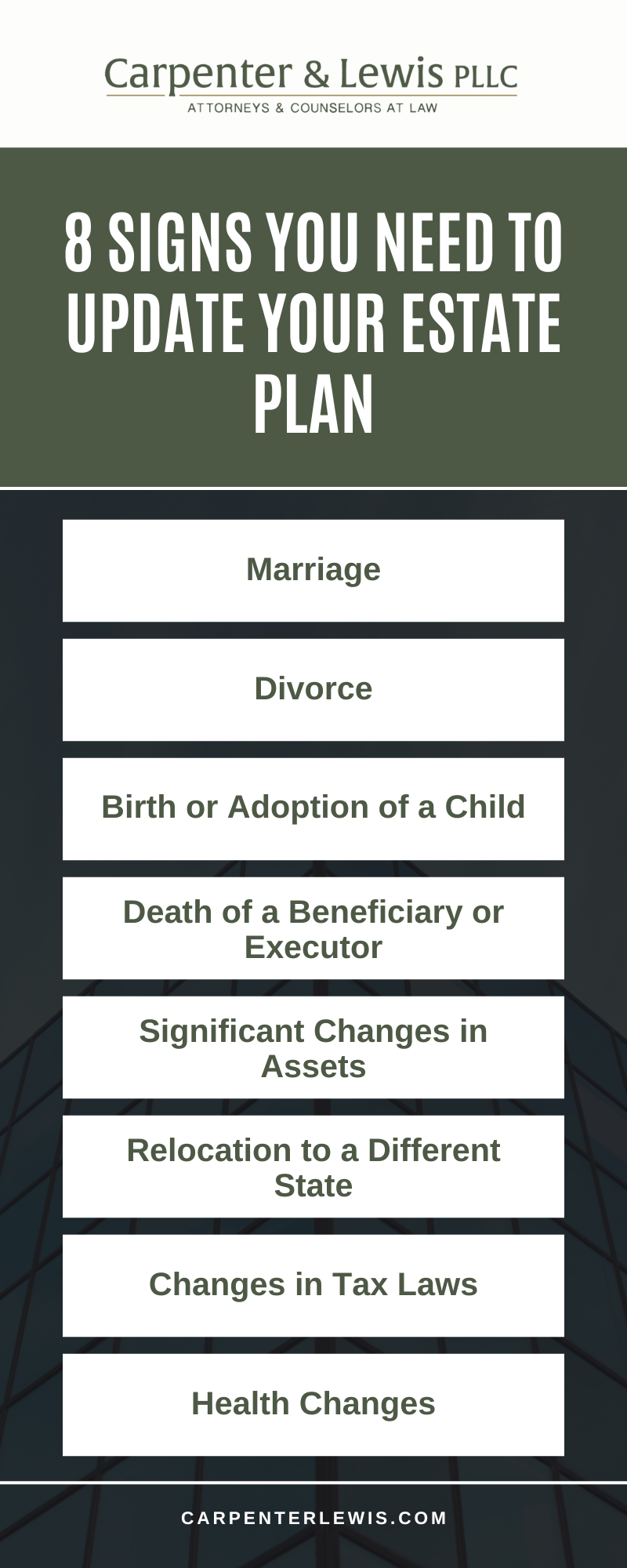

8 Signs You Need To Update Your Estate Plan

An estate plan is crucial for ensuring that your assets are distributed according to your wishes and that your loved ones are taken care of after you pass away. However, an estate plan isn’t a set-it-and-forget-it document. Here are ten signs that it’s time to contact your Knoxville, TN, probate, and estate attorneys to update your estate plan.

- Marriage

Marriage is a significant life event that requires updating your estate plan. Whether it’s your marriage or a significant change in your beneficiary’s marital status, updating your will, trusts, and beneficiary designations ensures that your spouse is appropriately included and your assets are distributed according to your new family dynamics.

- Divorce

Similarly, divorce necessitates a review of your estate plan. You may need to remove your ex-spouse from your will, trusts, power of attorney, and other estate planning documents. This prevents unintended beneficiaries and ensures your assets are directed toward your intended heirs.

- Birth or Adoption of a Child

Welcoming a new child into your family is a joyous occasion that calls for an update to your estate plan. You’ll want to ensure that your new child is included as a beneficiary and that provisions for their care and guardianship are in place in case something happens to you.

- Death of a Beneficiary or Executor

If a beneficiary, trustee, or executor named in your estate plan passes away, updating your documents is crucial. This ensures that your estate is managed and distributed by and to the right people without legal complications or delays.

- Significant Changes in Assets

If you experience a substantial increase or decrease in your assets, your estate plan should reflect these changes. This includes acquiring new properties, investments, or businesses or selling major assets. Updating your estate plan ensures accurate asset distribution and can help mitigate tax liabilities.

- Relocation to a Different State

Estate laws vary significantly from state to state. If you move to a different state, reviewing and updating your estate plan to ensure it complies with local laws is important. This can prevent legal challenges and ensure that your plan is executed smoothly.

- Changes in Tax Laws

Tax laws related to estate planning can change, impacting how your estate is taxed. Staying informed about these changes and updating your estate plan accordingly can help minimize tax liabilities for your heirs and maximize the value of your estate.

- Health Changes

A significant change in your health can prompt the need for updates to your estate plan. This might include revising your healthcare proxy, power of attorney, or living will to ensure that your medical and financial decisions are handled according to your wishes.

How Long Has It Been Since You Updated Your Estate Plan?

Significant life events such as marriage, divorce, the birth of a child, and changes in health, assets, or relationships necessitate a review of your estate plan. How long has it been since you’ve updated yours? Even if we didn’t create the initial estate plan, the Knoxville probate and estate attorneys from Carpenter & Lewis PLLC can alter yours to better suit your current status.

Probate And Estate Administration Infographic

FAQ: Understanding Probate And Estate Lawyers

Navigating the legal complexities of probate and estate planning can be overwhelming, especially during emotionally challenging times. Knoxville, TN probate and estate lawyers focus on guiding individuals and families through these processes, ensuring that legal matters are handled efficiently and effectively. Here are answers to some frequently asked questions about probate and estate lawyers:

1. What Is A Probate Lawyer?

A probate lawyer is an attorney who focuses on managing the legal process of probate. Probate is the court-supervised procedure of settling a deceased person’s estate, which includes validating the will, paying debts and taxes, and distributing assets to beneficiaries. Probate lawyers assist executors, administrators, or beneficiaries in fulfilling their legal obligations and resolving disputes.

2. How Does An Estate Lawyer Differ From A Probate Lawyer?

An estate lawyer focuses on helping individuals plan for the management and distribution of their assets during their lifetime and after death. This includes drafting wills, establishing trusts, and advising on tax strategies. While probate lawyers handle matters after a person’s death, estate lawyers work proactively to create a clear plan to avoid or simplify probate.

3. Do I Need A Probate Lawyer If There Is No Will?

Yes, if a person dies without a will (intestate), a probate lawyer can help navigate the state’s intestacy laws, which dictate how assets are distributed. The lawyer assists in appointing an administrator and ensures compliance with legal requirements to distribute the estate fairly and lawfully.

4. Can An Estate Lawyer Help Minimize Taxes On My Estate?

Absolutely. Estate lawyers are well-versed in tax laws and can implement strategies to reduce estate and inheritance taxes. For instance, they may suggest setting up irrevocable trusts, gifting assets during your lifetime, or creating charitable contributions to minimize tax liabilities.

5. How Do Probate And Estate Lawyers Handle Disputes?

Disputes often arise during probate, such as challenges to the validity of a will, disagreements among beneficiaries, or claims by creditors. Probate and estate lawyers act as mediators, offering legal advice and representation to resolve conflicts efficiently. If necessary, they will represent their clients in court to ensure their rights are protected.

6. Can I Avoid Probate With Proper Estate Planning?

Yes, with effective estate planning, you can often bypass or streamline the probate process. Common strategies include establishing living trusts, designating beneficiaries for financial accounts, and holding property jointly. Estate lawyers are essential in crafting these plans to ensure they align with your goals and state laws.

7. How Much Do Probate And Estate Lawyers Charge?

Fees vary depending on the complexity of the estate, the services provided, and the lawyer’s experience. Probate lawyers often charge a flat fee, hourly rate, or a percentage of the estate’s value. Estate lawyers typically charge flat fees for planning services like drafting wills and trusts.

8. When Should I Contact A Probate Or Estate Lawyer?

Contact an estate lawyer as soon as you start planning your financial future. This proactive approach ensures your wishes are documented and your loved ones are protected. If you’re dealing with probate, it’s best to consult a probate lawyer immediately to avoid delays and errors in the legal process.

By understanding the roles of Knoxville probate and estate lawyers from Carpenter & Lewis PLLC, you can make informed decisions to protect your assets and provide peace of mind for your family. Whether planning for the future or addressing a loved one’s estate, these professionals offer invaluable support.

Lawyer Stephen Carpenter | Featured Attorney Estate Planning

Request A Consultation

Client Review

“We own several businesses and have had the pleasure of working with Stephen and his team for over 9 years now. He always comes through in a pinch. They have assisted us with leases, estate planning, company formations and even landlord issues. I highly recommend them for all your business attorney needs!”

Mary Ellen Nichols

Probate - Frequently Asked Questions (and Answers!)

Probate is a legal process necessary to administer certain kinds of property owned by someone who has died (called the “Decedent”), to (1) confirm that claims, expenses and taxes are properly paid, and to (2) ensure that the remaining estate is distributed to those entitled to receive it in the Decedent’s will (known as a “testate” estate) or under Tennessee “intestacy” law if someone dies with no will.

The probate process generally takes place in the probate court of the county where the Decedent lived. If the Decedent also owned real estate or property located in another state, additional steps (quite possibly an “ancillary” probate) may be necessary in that state.

Probate property generally is all property titled in the Decedent’s name individually (not “jointly” with others) and with no legal designated beneficiary.

Often some property will not be probate property, and therefore is not part of the probate estate. Such property not necessary to be probated often includes: property jointly held by the Decedent and another person, property held in a trust, accounts that are payable on death (POD) or that transfer on death (TOD) to a named beneficiary, and insurance or retirement benefits that are payable to a named beneficiary.

A point which is often mistaken: property that must be included in probate and property that is subject to estate taxes are two different matters. Even if property is not included in probate, it still may be included when adding up assets for federal estate tax purposes.

Probate is necessary to give the person authorized by law (whether in the Decedent’s will or, if there is no will, then under Tennessee law) legal authority to deal with the Decedent’s probate assets. Such person is referred to as an “executor”, “administrator”, or “personal representative”. A will is not effective until a judge determines it is valid. Once validated and a probate estate is opened with the court, the executor or administrator has the authority and duty to take control of and safeguard the assets of the Decedent’s estate. Probate then provides a process for the payment of outstanding debts, taxes, and the expenses of administration, and for the distribution of the remainder of the estate to the beneficiaries and heirs.

Probating an estate requires the appointment of a person to conduct the administration of the estate. If there is a will, this person usually is named in the will and is called an executor. If there is no will or no person is named in the will, this person is appointed by the probate court and is called an administrator. The executor or administrator may be an individual, a bank or a trust company, and is also often referred to as a “personal representative”.

Carpenter & Lewis provides executors and administrators help with many aspects of administering a Decedent’s estate, including:

These tasks require the preparation and filing of numerous legal documents, and often the preparation of various notices, potential hearings in court, an appraisal of the assets of the estate, an inventory of the assets, an accounting of funds, final transfer of all assets to beneficiaries, termination of the probate proceeding, and discharge of the executor or administrator by the probate court.

Claims against the estate may generally be made up to four months after a probate is opened and the creditor is properly notified by actual or “publication” notice by law. A small estate that has no beneficiary or creditor issues often can be settled within six months of the appointment of the executor or administrator. The administration of a probate estate will usually take at least six total months and often can often last more than a year, depending on difficulties or complexities in distribution of assets and any beneficiary or creditor issues.

Carpenter & Lewis routinely handles the probate of estates in Knox, Anderson, Blount, Loudon, Union, and other surrounding East Tennessee counties. Our attorneys are able to assist in all such matters, having walked hundreds of clients through the probate process.

Most courts in Tennessee do not require you to hire an attorney to probate an estate. So, our clients often ask, why then should an attorney be used for probate?

Our clients also tend to find that most county courts and probate offices either strongly recommend legal assistance or instead generally will not answer questions of any legal nature from personal representatives. The probate process can become complicated with many potential pitfalls. Many personal representatives fail to realize until too late the high standard they are required to uphold when they take the required oath with the court to be personal representative. By accepting that position, they may be held personally liable for mistakes, whether it be a failure to provide proper notice to beneficiaries or creditors, or missing important deadlines, or other missteps. Without the assistance of an attorney, personal representatives are generally left to determine which documents to file, which parties to notify, which deadlines apply to them, and which procedures to follow for distribution of the estate to beneficiaries.

Our firm has been involved in countless probates where clients chose to start the process on their own, only to find that they were unable to complete the process or, even worse, that they needed emergency help to fix a costly mistake in their administration of the estate. We have found numerous probate situations that would be very difficult to handle without competent legal advice and guidance, such as:

- Anticipated family conflicts (such as blended families, numerous beneficiaries, minors receiving money, trusts receiving money);

- Ambiguity in the language of the Will (family likely to fight about what something means or to grapple over conflicting interpretations of unclear provisions);

- Estates with diverse or large quantities of assets, including making valuations;

- Transfer of a business;

- Creditor claims that are incorrect;

- TennCare estate recovery issues (if government benefits were paid out);

- Federal or state tax issues (whether estate tax or income tax claims);

- Insolvency issues (the estate not having enough money to pay debts); and

- Real estate transfers

Our firm has decades of experience in handling probate estates for clients. We recognize both the difficult emotional time it often is for clients and also the need to walk clients comfortably through the probate process in a fair and cost-effective manner. Let us help you.

Client Review

“We own several businesses and have had the pleasure of working with Stephen and his team for over 9 years now. He always comes through in a pinch. They have assisted us with leases, estate planning, company formations and even landlord issues. I highly recommend them for all your business attorney needs!”

Mary Ellen Nichols

Probate FAQ

Our firm has decades of experience in handling probate estates for clients. Let us help you with answering the most frequently asked questions.

Is an Attorney Necessary?

Generally, courts in Tennessee do not require you to hire an attorney to probate an estate, although clients tend to find that most county courts and probate offices either strongly recommend legal assistance or instead generally will not answer questions from Executors of any legal nature.

Checkout our latest ideas

Press & Media

Schedule Your Appointment

10413 Kingston Pike, Suite 200

Knoxville, Tennessee 37922

New Clients: (865) 509-9600

Existing Clients: (865) 690-4997

Facsimile: (865) 690-4790

10413 Kingston Pike, Suite 200 Knoxville, Tennessee 37922

Also Serving: Farragut TN

New Clients: (865) 509-9600

Existing Clients: (865) 690-4997

Facsimile: (865) 690-4790

Estate Planning Lawyer Knoxville TN | Wills Lawyer Knoxville TN | Probate Lawyer Knoxville TN | Elder Law Lawyer Knoxville TN | Estate Settlement Attorney Knoxville TN | Wills Lawyer Farragut TN | Trust Lawyer Farragut TN | Probate Lawyer Farragut TN | Estate Planning Lawyer Maryville TN | Probate Lawyer Maryville TN | Wills Lawyer Maryville TN | Elder Law Lawyer Maryville TN | Trust Lawyer Maryville TN | Small Business Lawyer Madisonville TN