Trust Lawyer Maryville, TN

At Carpenter & Lewis PLLC, we focus on the future of all families. We understand that many people want to be prepared in case something unexpected happens. It is the truth of our existence that we are mortal beings and one day we will pass away. When that day comes, you can have peace of mind knowing that your estate plan has instructions for to whom and which belongings will be distributed. It is our role to help inform and educate clients about the principles of estate planning, so they understand the gravity of what is at stake. As our Maryville, TN trust lawyer warns, if you do not develop an estate plan before you pass, then your estate will be overseen and distributed based on state law by the court system. Knowing this is often enough motivation for families to come to us to create a legally binding state plan, because they would prefer to court to not have a say in how their estate is handled.

Tips For Your Estate Plan

Being able to write an estate plan is important in making sure your wishes are followed and assets are safeguarded after you pass away. By taking the time now to plan ahead, you can give your surviving loved ones clarity and ease of mind during a difficult time. Do not wait until you are of older age or in poor health just to start this process. By beginning early, you have a chance to carefully consider what your wishes are, consult with professionals, and make any adjustments as your life changes. Once you have written your estate plan, you may need to update it as life goes on so that it always reflects your current reality and situation.

Inventory Of Your Assets

As another step in writing your estate plan, it’ll be important to write a list of all of your assets, including financial, belongings, and sentimental items that may not be of high value. Essentially, anything that you own that would need to be distributed to someone else when you pass away is something to write in your inventory of assets. After you have this list, you can think about who you would like to receive each of these assets. As our knowledgeable trust attorney explains, beneficiaries can be family members, friends, or charity organizations.

Carpenter & Lewis PLLC

Planning for a time when you are no longer here is a crucial step in protecting your assets and ensuring that your closest loved ones receive their inheritances smoothly during a time of need and grief. Our team at Carpenter & Lewis PLLC understands that thinking about a time when you are not here anymore can be emotional. Developing an estate plan may feel like an odd task at first, but if you do not have an estate plan then you risk the court system handling your assets for you. If you are ready to learn more about estate planning and possibly get started today, then please reach out to our TN trust attorney so that we can consult with you further. We hope to hear from you today.

How A Trust Lawyer Can Help You Avoid Probate

When planning for the future, one of the most important goals for many individuals is to make sure that their loved ones receive their inheritance without unnecessary delays or complications. One of the best ways to achieve this is to avoid probate, the legal process of validating a will and distributing assets after death. While probate can be lengthy, expensive, and stressful for beneficiaries, working with our trust lawyers can help you create an estate plan that circumvents probate entirely. Here’s how our Maryville, TN trust lawyer can assist in avoiding probate and streamlining the transfer of your assets.

1. Creating A Living Trust

One of the most effective ways to avoid probate is by setting up a living trust. A living trust allows you to transfer ownership of your assets while you’re alive into a legal entity, known as a trust. With this type of trust, you, as the creator (or “grantor”), maintain control over the assets during your lifetime. After your death, the assets are distributed to your chosen beneficiaries according to the terms of the trust without the need for probate.

Our living trust lawyer will help you draft the trust document, ensuring that it’s legally sound and properly executed. We will also guide you through the process of funding the trust, which involves transferring ownership of assets such as real estate, bank accounts, investments, and personal property into the trust. Without proper legal assistance, your trust might not be set up correctly, which could still lead to probate.

2. Confirming Proper Asset Titling

One of the common mistakes people make when creating a trust is failing to properly title their assets. If the assets aren’t transferred into the trust, they won’t be subject to the terms of the trust, meaning they could still end up in probate.

Our lawyer will make sure that all relevant assets are properly titled in the name of the trust. This might involve retitling real estate deeds, changing the ownership of financial accounts, or updating beneficiary designations on life insurance policies and retirement accounts.

3. Avoiding Court Supervision

Another way our attorney can help you avoid probate is by making sure that your estate plan is structured in a way that minimizes court supervision. Probate often requires court approval for various stages of the estate administration process, such as validating the will, appointing an executor, and resolving disputes. Our trust attorney can help you create a comprehensive estate plan that reduces or eliminates the need for court involvement, streamlining the distribution of assets to your beneficiaries.

Unlike a will, a trust offers privacy. Probate is a public process, meaning that the details of your estate, debts, and beneficiaries could become part of the public record. A trust, on the other hand, allows for the private transfer of assets, protecting your family’s privacy.

Protect Your Legacy and Prevent Disputes

Avoiding probate can save your loved ones time, money, and stress after your passing. By working with our Maryville trust lawyer from Carpenter & Lewis PLLC, you can make sure that your estate is properly planned, your assets are titled correctly, and your beneficiaries receive their inheritance without going through the probate process. Whether you’re just starting your estate plan or need to update an existing one, our lawyer’s expertise is invaluable in securing your legacy and simplifying the transfer of assets to your heirs.

Why You Should Consider A Trust Attorney For Your Estate Planning Needs

When planning for the future, many people think of writing a will to manage how their assets will be distributed. However, establishing a trust can offer even more advantages, especially when you have specific wishes about asset protection, privacy, or provisions for family members. Our Maryville, TN trust lawyer can help you create a customized trust plan, so that your assets are managed exactly as you intend. Here’s why consulting a trust lawyer for your estate planning needs can be a wise choice.

Guidance In Choosing The Right Type Of Trust

Trusts come in many forms, and each type serves a different purpose. Our trust lawyers can help you understand these options to find one that meets your goals. Whether you’re considering a revocable trust, which allows you to adjust your plans during your lifetime, or an irrevocable trust, which can protect assets from creditors, our lawyer will explain each option’s benefits and limitations. There are also focused trusts, like special needs trusts, charitable trusts, and generation-skipping trusts, each requiring precise legal handling to make sure they function as intended. We will make sure that your chosen trust is tailored to your situation, optimizing asset protection and distribution.

Avoiding Probate And Maintaining Privacy

One of the major advantages of a trust is that it helps bypass probate, the court-supervised process of distributing assets. Probate can be time-consuming and costly, delaying the transfer of assets to your heirs. Additionally, because probate is a public process, anyone can access information about your estate and beneficiaries. By setting up a trust with the help of a trust lawyer, you can avoid these drawbacks.

Protection For Minors And Family Members

If you have young children or family members with specific needs, a trust can ensure that their inheritance is managed responsibly. A trust lawyer can help set up terms and conditions to protect these beneficiaries. For instance, you may wish to establish a trust that only allows funds to be used for education or living expenses until your children reach a certain age. Or, if you have a family member with disabilities, a trust lawyer can create a special needs trust, ensuring they receive financial support without impacting eligibility for government benefits.. These detailed provisions help secure your loved ones’ future without risking their financial stability.

Minimizing Estate Taxes And Protecting Assets

For larger estates, minimizing estate taxes is a common goal. Our trust attorney can help by setting up trusts that reduce or delay tax burdens on your estate, preserving more wealth for your heirs. Certain trusts, like irrevocable life insurance trusts (ILITs), remove the value of life insurance from your taxable estate. Additionally, trust lawyers can design trusts that shield assets from creditors or lawsuits, giving your family greater financial security.

Peace Of Mind For The Future

Our Maryville trust attorney helps you gain peace of mind by developing a secure, well-organized estate plan. Knowing that your assets will be managed according to your wishes can alleviate concerns about your family’s future. With our guidance, you’re not just creating a financial plan; you’re building a lasting legacy. Investing in our legal services allows you to feel confident in the future you’re creating for yourself and your loved ones.

Maryville Trust Infographic

Maryville Trust Statistics

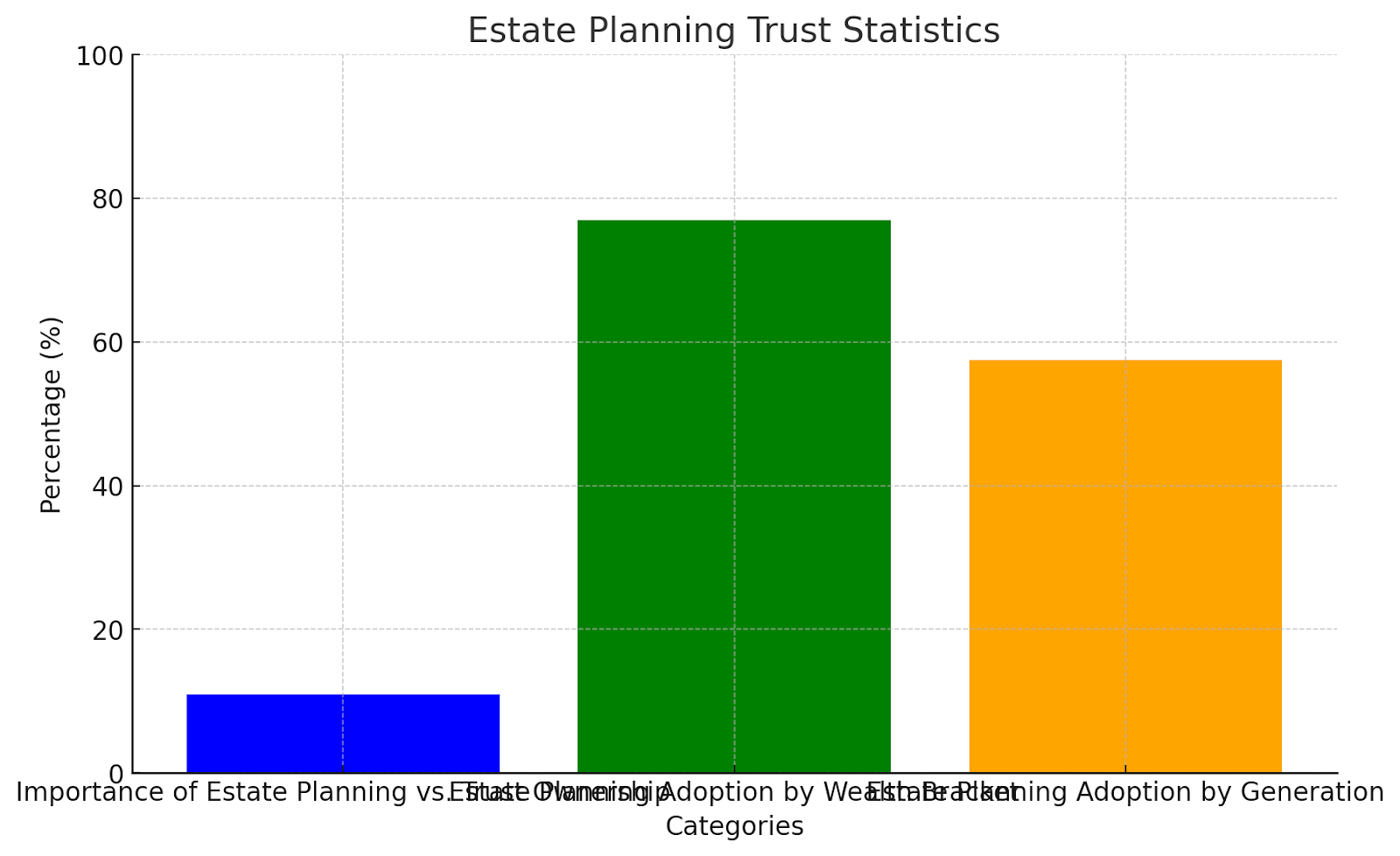

Estate planning trusts are essential tools for managing and distributing assets, yet their adoption rates remain surprisingly low among Americans.

Despite 83% of Americans acknowledging the importance of estate planning, only 31% have a will, and a mere 11% have a trust. This discrepancy highlights a significant gap between awareness and action.

The prevalence of trust usage varies significantly across wealth brackets. Approximately 77% of individuals with a household net worth exceeding $1 million have an estate plan, will, or trust. In contrast, only 36% of those with a net worth of less than $1 million have similar estate planning documents.

Generational differences also influence estate planning behaviors. Among Baby Boomers, 57.5% have an estate plan, will, or trust, compared to 39% of Gen Z . This trend underscores the need for increased education and resources to encourage younger generations to engage in estate planning.

Trust FAQs

When it comes to managing and protecting your assets, creating a trust can be one of the most effective tools at your disposal. As trust lawyers, we often receive questions about what we do and how we can help you create a trust that meets your specific needs. Here are the most common questions we encounter and explain why working with our Maryville, TN trust lawyer is essential for your estate planning needs.

What Is A Trust, And Why Might I Need One?

A trust is a legal arrangement in which you (the grantor) transfer assets to a trustee to manage for the benefit of designated beneficiaries. Trusts can help you achieve various goals, such as avoiding probate, minimizing estate taxes, protecting assets, and making sure that your wishes are carried out efficiently. We work closely with you to determine whether a trust is the right tool for your estate plan and which type of trust best suits your situation.

How Does A Trust Differ From A Will?

While both a trust and a will are tools for distributing your assets, they function differently. A will takes effect after your death and typically goes through probate, which can be time-consuming and costly. A trust, on the other hand, takes effect as soon as it is created and funded. It allows for the seamless transfer of assets to your beneficiaries, often bypassing probate altogether. We help you decide whether to use a trust, a will, or both, depending on your goals and circumstances.

What Are The Different Types Of Trusts?

There are many types of trusts, each designed to serve specific purposes. Some of the most common include:

- Revocable living trusts: Flexible trusts that you can modify or revoke during your lifetime.

- Irrevocable trusts: Fixed trusts that offer greater asset protection and tax benefits.

- Special needs trusts: Designed to provide for loved ones with disabilities without affecting their eligibility for government benefits.

- Charitable trusts: Used to support charitable causes while providing tax advantages.

- Testamentary trusts: Created through a will and activated upon your death.

We’ll guide you through the options and help you select the trust type that aligns with your goals.

How Do I Create A Trust?

Creating a trust involves several steps, including drafting the trust document, funding the trust with assets, and appointing a trustee. We take care of the legal and technical aspects, ensuring your trust is properly structured and meets all legal requirements. We also provide guidance on funding the trust, which involves transferring ownership of your assets to the trust.

Trusts are powerful tools for protecting and distributing your assets, but they require careful planning and expertise to create. As Maryville trust lawyers, we are here to guide you through every step of the process, ensuring your trust meets your needs and provides peace of mind for you and your loved ones. If you’re considering setting up a trust, we at Carpenter & Lewis PLLC can help.

Trust Glossary

When working with our Maryville, TN trust lawyer, you’ll likely encounter legal language with a specific focus that may be unfamiliar at first. Trust law involves the creation and management of legal entities (trusts) that hold assets for the benefit of others. Whether you’re planning your estate or managing a loved one’s affairs, it’s helpful to understand some of the foundational terms in this area of law. Since 1989, our team at Carpenter & Lewis PLLC has faithfully served our clients’ legal needs. Below, we have provided five essential legal terms and concepts you may come across when working with our experienced trust attorney:

Trustee

A trustee is the individual or entity appointed to manage the assets placed in a trust. The trustee is legally responsible for administering the trust according to its terms and in the best interests of the beneficiaries. Trustees have a duty to act impartially and prudently, managing investments, distributing funds, and keeping accurate records. This role can be filled by a family member, a trusted friend, or a professional fiduciary, such as our Maryville estate planning lawyer or a financial institution. Mismanagement by a trustee can lead to legal consequences.

Beneficiary

A beneficiary is the person or entity that benefits from the trust. This can include children, grandchildren, spouses, charities, or even organizations. The trust document outlines how and when beneficiaries receive their share of the trust assets. Beneficiaries have the right to be informed about the trust and may have legal standing to challenge a trustee’s actions if they believe their interests are not being properly served.

Grantor

The grantor, also known as the settlor or trustor, is the person who creates the trust. They contribute the initial assets and determine the trust’s terms, such as how assets are to be managed and distributed. In revocable trusts, the grantor can modify or dissolve the trust during their lifetime. In irrevocable trusts, however, they relinquish control once the trust is established. The grantor’s decisions at the outset shape how the trust operates for years to come.

Fiduciary Duty

Fiduciary duty is a legal obligation that requires one party to act in the best interests of another. In the context of trusts, the trustee owes a fiduciary duty to the beneficiaries. This includes duties of loyalty, care, and transparency. The trustee must avoid conflicts of interest and always act in good faith. According to our Maryville trust attorney, breaching fiduciary duty can result in personal liability for the trustee and possible removal from their role.

Irrevocable Trust

An irrevocable trust is a type of trust that cannot be modified or terminated without the consent of the beneficiaries (and sometimes the court). This distinguishes it from a revocable trust, which the grantor can modify at any time during their life. By transferring assets into an irrevocable trust, the grantor effectively removes them from their personal ownership and estate.

This kind of trust is commonly used in advanced estate planning strategies. It can help minimize estate taxes, protect assets from creditors or lawsuits, and establish eligibility for government benefits like Medicaid by reducing countable assets.

Secure Your Family’s Future With Comprehensive Estate Planning

At Carpenter & Lewis PLLC, we understand that planning for the future can feel overwhelming, but it is one of the most important steps you can take to protect your loved ones. With over 40 years of estate planning experience, our Maryville, TN trust lawyer has guided families through every aspect of wills, trusts, and probate avoidance strategies. We help make sure that your assets are distributed according to your wishes, your heirs are cared for, and your legacy is preserved.

Whether you’re just starting your estate plan or updating an existing one, our team is here to provide personalized guidance, practical solutions, and peace of mind. Contact us today to schedule a consultation and take the first step toward a secure and organized future for you and your family.

Request A Consultation

Client Review

“We own several businesses and have had the pleasure of working with Stephen and his team for over 9 years now. He always comes through in a pinch. They have assisted us with leases, estate planning, company formations and even landlord issues. I highly recommend them for all your business attorney needs!”

Mary Ellen Nichols

Schedule Your Appointment

10413 Kingston Pike, Suite 200

Knoxville, Tennessee 37922

New Clients: (865) 509-9600

Existing Clients: (865) 690-4997

Facsimile: (865) 690-4790

10413 Kingston Pike, Suite 200 Knoxville, Tennessee 37922

Also Serving: Farragut TN

New Clients: (865) 509-9600

Existing Clients: (865) 690-4997

Facsimile: (865) 690-4790

Community Property Trust Lawyer Knoxville TN

Probate Lawyer Knoxville TN

Probate Lawyer Madisonville TN

Probate Lawyer Maryville TN

Business Sale Lawyer Knoxville TN

Business Purchase Lawyer Knoxville TN

Business Contract Lawyer Knoxville TN

Business Transactions Lawyer Knoxville TN

Small Business Lawyer Knoxville TN

Business Formation Lawyer Alcoa TN

Business Purchase Lawyer Lenoir City TN

Business Sale Lawyer Alcoa TN

Business Sale Lawyer Lenoir City TN

Business Contract Lawyer Seymour TN

Living Trust Lawyer Seymour TN