Knoxville Elder Law Lawyer

Elder Law Lawyer Knoxville, TN

Problems with Medicare and Medicaid

Once you reach 65, you may be automatically eligible for Medicare. However, in order to qualify for Medicaid, you have to make under a certain income each year. It is possible that you may qualify for both programs. However, there are strict guidelines for dual eligibility. An experienced attorney can help you understand the restrictions and determine if you qualify for both programs or not.

Experiencing Elder Abuse

Unfortunately, elder abuse is more common than many people think. Some caregivers take advantage of elderly people because they may be more vulnerable. Elder abuse may include physical, emotional and financial abuse and neglect. Elder abuse can occur in many different settings, from nursing homes to elderly people’s homes, and may happen due to caregiver burnout, understaffing, poor pay or inadequate training. No one deserves to experience abuse. If you or a family member has endured elder abuse, you may want to speak to an attorney about your legal options.

Getting Long-Term Care

Medical care can get more costly when you get older, especially if you develop a chronic illness. You may even have to stay in a nursing home, which can easily cost thousands of dollars a year. If you are concerned that your health insurance will not cover all of these costs, you may want to consult a Knoxville elder law attorney. He or she can provide you with more information about long-term care and advise you on how to pay for it. For example, you may use your pension, savings or long-term care insurance to fund the care.

Creating an Estate Plan

Estate planning is important for people of all ages, including senior citizens. A proper estate plan ensures that your final wishes are carried out and your loved ones are taken care of. However, establishing an estate plan can be complicated and confusing. You do not want to risk making a mistake. That is another good reason to contact an elder law attorney. He or she can help you establish a valid estate plan that clearly states your wishes. Your attorney can give you sound legal advice and answer all of your questions.

Getting Military Benefits

If you are a veteran, you may be eligible for additional benefits as you get older. You may have sustained serious injuries in battle or have suffered emotional injuries after the fact. An experienced attorney can inform you about the benefits you may be entitled to and help you go after them.

If you need assistance with any elder law matters, you may want to schedule a consultation with a Knoxville elder law attorney from Carpenter & Lewis PLLC to discuss your concerns.

Comprehensive Legal Services For Seniors

Your Knoxville, TN elder law lawyer can help you build the best future possible for yourself, and for your loved ones. At Carpenter & Lewis PLLC, we understand that planning for the future and ensuring continued autonomy over financial and health decisions is crucial for our senior clients. Our dedicated attorneys are committed to providing tailored advice and comprehensive solutions that respect the dignity and intentions of each individual.

What Is Elder Law?

Elder law encompasses a variety of legal matters that affect older or disabled individuals. The primary aim is to assist our clients in achieving the best quality of life by securing their health and wealth as they age. This field combines parts of several types of law, including elements of real estate, trust and estate planning, and family law, which are relevant to the issues facing elderly populations.

Why Elder Law May Be Necessary

As one advances in age, certain legal issues become more prominent. Issues such as determining eligibility for Medicaid to cover long-term care costs or executing powers of attorney that delegate decision-making in the event of incapacity become critical. Without proper legal advice, you might find yourself unable to manage your affairs or protect your assets from unexpected medical costs.

Moreover, elder law aims to provide peace of mind for both the individuals planning their estates and their loved ones. Through comprehensive estate planning, including wills, trusts, and advance directives, our lawyers ensure that your assets are protected and your wishes are respected.

How We Can Help

Unlike other law firms, our team focuses solely on estate and transactional law. This means we’re specialists when it comes to elder law, and ensuring your last wishes are honored – whatever they may be. From drafting wills and trusts to more complex procedures like applying for Medicaid or establishing legal guardianship, our attorneys are here to assist with all your elder law needs.

We take pride in our ability to offer compassionate and effective counsel, helping our clients to maintain their independence and ensure their wishes are carried out. Whether you are looking to plan for your future needs or facing an immediate legal concern, we’re here to provide the reliable legal support you require.

Planning For Peace Of Mind

Estate planning is a significant part of elder law and involves preparing for the management of one’s estate during life and after death. Our attorneys help you understand the various options available for protecting your estate, including the creation of trusts to avoid probate or the drafting of living wills that specify your wishes regarding medical treatment.

The goal is to avoid the financial burdens that often accompany aging and illness, ensuring that your assets are utilized as you see fit, rather than being consumed by taxes or medical expenses. Our thorough understanding of state and federal laws enables us to offer strategies that minimize exposure to these risks.

Reach Out Today For Focused Support

At Carpenter & Lewis PLLC, our team is standing by to support you as you build a better tomorrow. Get in touch with us today, and see how an elder law attorney from our office can help.

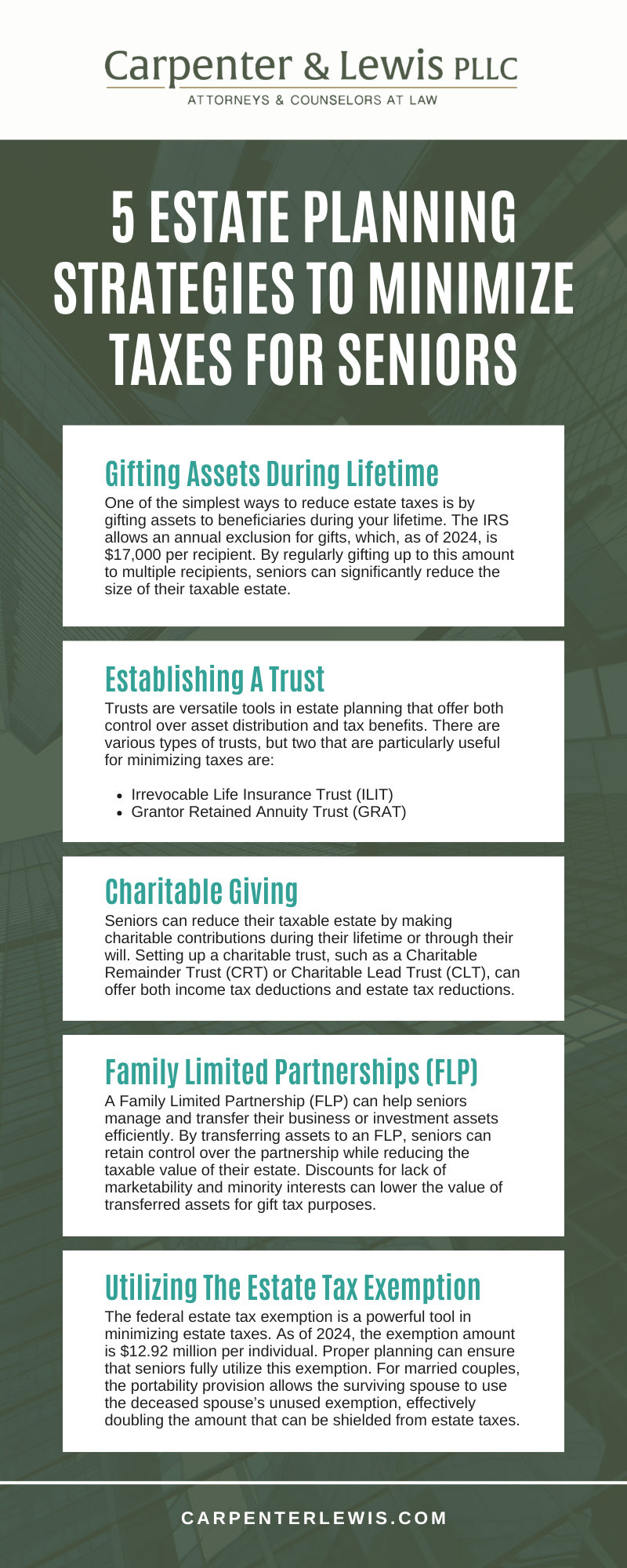

5 Estate Planning Strategies To Minimize Taxes For Seniors

Estate planning is crucial for seniors looking to preserve their wealth and ensure a smooth transition of assets to their heirs. Minimizing taxes is a key component of this process. If you’re worried about your tax burden after retirement and into your Golden Years, turn to an experienced Knoxville, TN, estate planning lawyer from Carpenter & Lewis PLLC to help you explore your estate planning options.

1. Gifting Assets During Lifetime

One of the simplest ways to reduce estate taxes is by gifting assets to beneficiaries during your lifetime. The IRS allows an annual exclusion for gifts, which, as of 2024, is $17,000 per recipient. By regularly gifting up to this amount to multiple recipients, seniors can significantly reduce the size of their taxable estate. Moreover, these gifts can appreciate outside of the senior’s estate, further minimizing potential estate taxes.

2. Establishing A Trust

Trusts are versatile tools in estate planning that offer both control over asset distribution and tax benefits. There are various types of trusts, but two that are particularly useful for minimizing taxes are:

- Irrevocable Life Insurance Trust (ILIT): By placing a life insurance policy in an ILIT, the death benefits are removed from the taxable estate. This can significantly reduce estate taxes while providing beneficiaries with tax-free proceeds.

- Grantor Retained Annuity Trust (GRAT): A GRAT allows seniors to transfer appreciating assets at a reduced gift tax cost. The grantor receives an annuity for a specified term, and any remaining assets pass to beneficiaries, potentially free of additional gift and estate taxes.

3. Charitable Giving

Seniors can reduce their taxable estate by making charitable contributions during their lifetime or through their will. Setting up a charitable trust, such as a Charitable Remainder Trust (CRT) or Charitable Lead Trust (CLT), can offer both income tax deductions and estate tax reductions. A CRT allows the donor to receive income for life or a specified term, with the remainder going to charity, while a CLT provides the charity with income for a period before transferring the remaining assets to beneficiaries.

4. Family Limited Partnerships (FLP)

A Family Limited Partnership (FLP) can help seniors manage and transfer their business or investment assets efficiently. By transferring assets to an FLP, seniors can retain control over the partnership while reducing the taxable value of their estate. Discounts for lack of marketability and minority interests can lower the value of transferred assets for gift tax purposes. This strategy can significantly reduce estate taxes while keeping assets within the family.

5. Utilizing The Estate Tax Exemption

The federal estate tax exemption is a powerful tool in minimizing estate taxes. As of 2024, the exemption amount is $12.92 million per individual. Proper planning can ensure that seniors fully utilize this exemption. For married couples, the portability provision allows the surviving spouse to use the deceased spouse’s unused exemption, effectively doubling the amount that can be shielded from estate taxes.

Your Trusted Knoxville Elder Law Lawyers

Effective estate planning for seniors involves a combination of strategies to minimize taxes and maximize the value of their assets for their beneficiaries. Contact an experienced Knoxville elder law lawyer from Carpenter & Lewis PLLC to incorporate these strategies into your estate plan.

Knoxville Elder Law Infographic

Knoxville Elder Lawyer Statistics

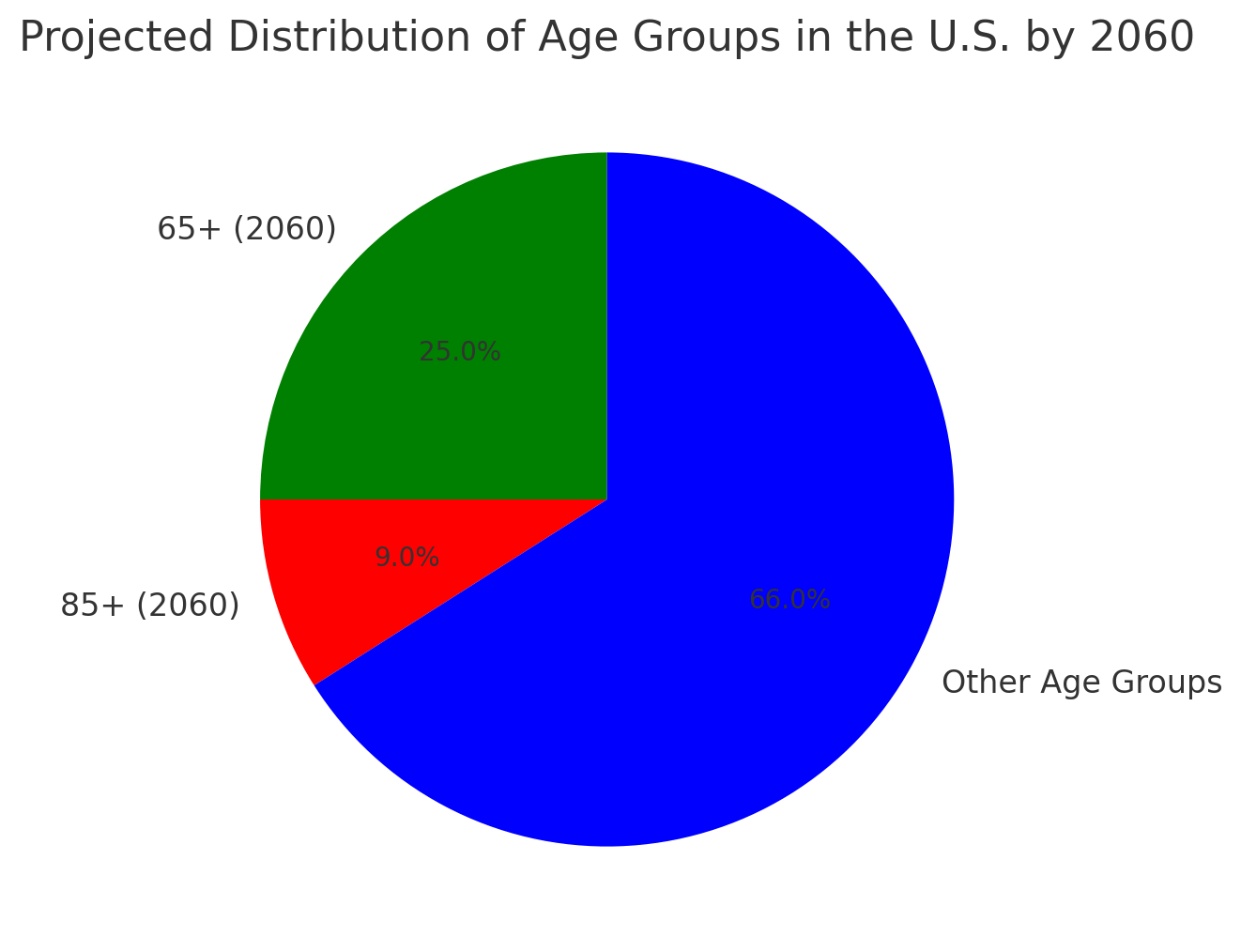

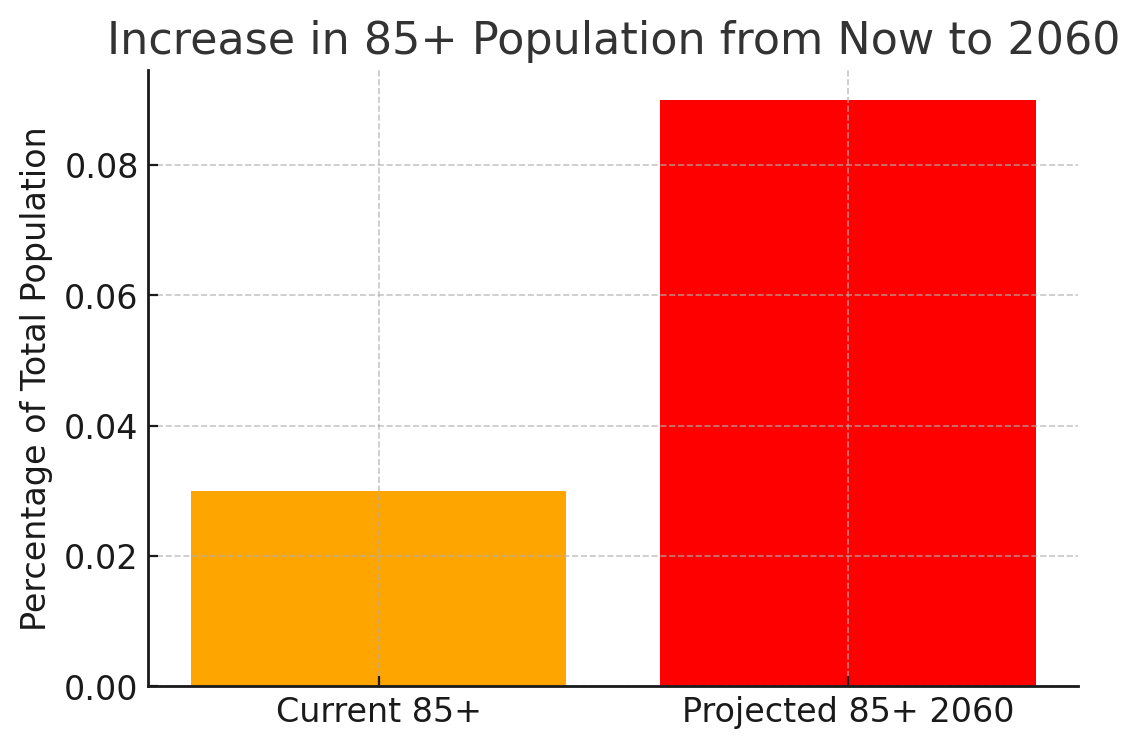

According to the U.S. Census Bureau, by the year 2060, a quarter of the U.S. population will be 65 years of age or older. The Census Bureau also predicts that the number of people in this country who are 85 years or older will triple the number is right now. However, this also means that many of these older Americans will need to be placed in assisted living or nursing homes as they age and become unable to care for themselves.

The costs of these facilities are astronomical and can result in wiping out the life savings that the elder worked so hard all their lives to save. Don’t let this happen to you. Call a Knoxville elder law lawyer from our firm and find out how you can protect your assets.

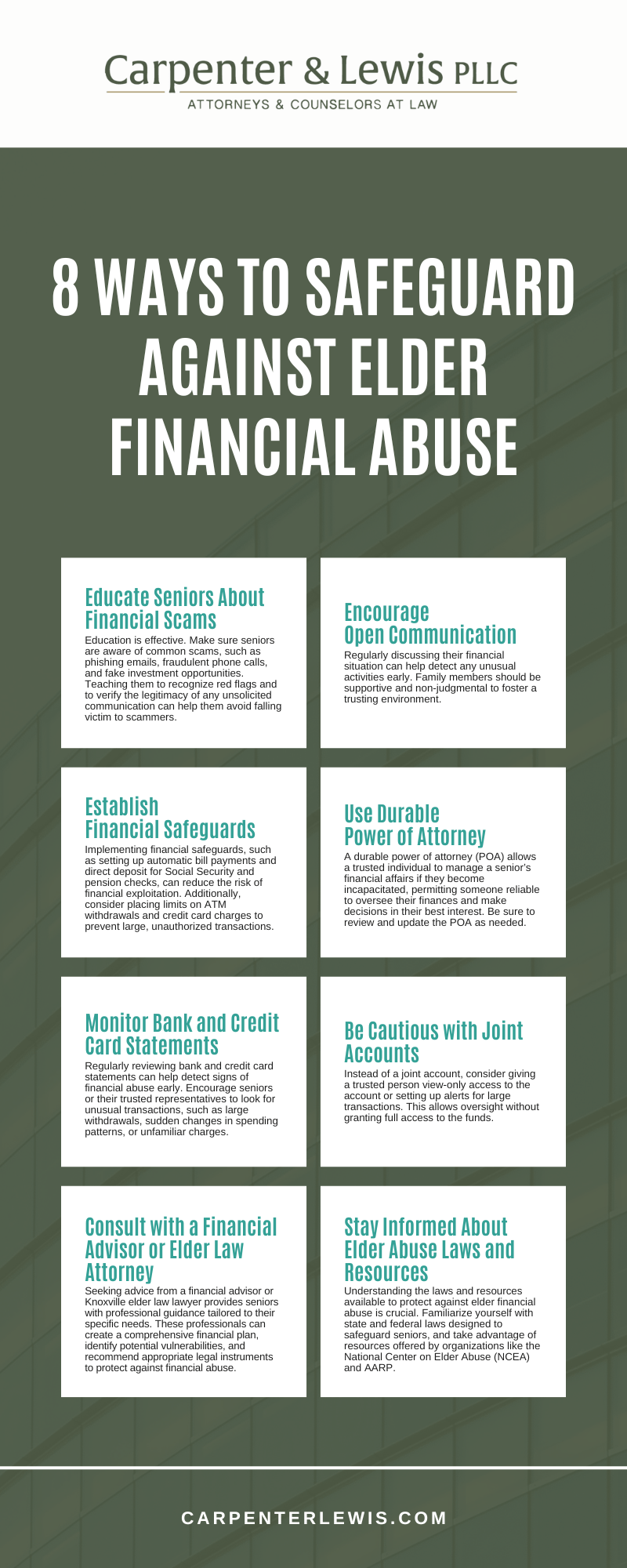

8 Ways To Safeguard Against Elder Financial Abuse

The legal team at Carpenter & Lewis PLLC has seen a growing number of elder abuse cases. As more and more of the large “baby boomer” generation enters into retirement accommodations, from assisted living to memory care and skilled nursing facilities, so also have the occasions of elder financial abuse. Protecting older adults from such abuse requires awareness, proactive measures, and ongoing vigilance. Our legal team offers tips for families to protect their vulnerable senior loved ones.

- Educate Seniors About Financial Scams

Education is effective. Make sure seniors are aware of common scams, such as phishing emails, fraudulent phone calls, and fake investment opportunities. Teaching them to recognize red flags and to verify the legitimacy of any unsolicited communication can help them avoid falling victim to scammers.

- Encourage Open Communication

Regularly discussing their financial situation can help detect any unusual activities early. Family members should be supportive and non-judgmental to foster a trusting environment.

- Establish Financial Safeguards

Implementing financial safeguards, such as setting up automatic bill payments and direct deposit for Social Security and pension checks, can reduce the risk of financial exploitation. Additionally, consider placing limits on ATM withdrawals and credit card charges to prevent large, unauthorized transactions.

- Use Durable Power of Attorney

A durable power of attorney (POA) allows a trusted individual to manage a senior’s financial affairs if they become incapacitated, permitting someone reliable to oversee their finances and make decisions in their best interest. Be sure to review and update the POA as needed.

- Monitor Bank and Credit Card Statements

Regularly reviewing bank and credit card statements can help detect signs of financial abuse early. Encourage seniors or their trusted representatives to look for unusual transactions, such as large withdrawals, sudden changes in spending patterns, or unfamiliar charges.

- Be Cautious with Joint Accounts

Instead of a joint account, consider giving a trusted person view-only access to the account or setting up alerts for large transactions. This allows oversight without granting full access to the funds.

- Consult with a Financial Advisor or Elder Law Attorney

Seeking advice from a financial advisor or Knoxville elder law lawyer provides seniors with professional guidance tailored to their specific needs. These professionals can create a comprehensive financial plan, identify potential vulnerabilities, and recommend appropriate legal instruments to protect against financial abuse.

- Stay Informed About Elder Abuse Laws and Resources

Understanding the laws and resources available to protect against elder financial abuse is crucial. Familiarize yourself with state and federal laws designed to safeguard seniors, and take advantage of resources offered by organizations like the National Center on Elder Abuse (NCEA) and AARP. These organizations provide valuable information, support, and tools to help prevent and address financial exploitation.

Legal Advice To Pursue Elder Financial Abuse Claims

Protecting seniors from financial abuse requires a combination of education, vigilance, and proactive measures. By educating seniors about scams, encouraging open communication, and implementing financial safeguards, we can significantly reduce the risk of financial exploitation.

However, when the unthinkable happens, a Knoxville elder law lawyer from Carpenter & Lewis PLLC can help you hold the perpetrator accountable and file a claim for damages your loved one sustained. Call today for a free consultation.

Knoxville Elder Law Infographic

Knoxville Elder Law FAQs

Your Knoxville elder law lawyer can help you protect your future, and your family. At Carpenter & Lewis PLLC, we have over 30 years of experience doing just that. From probate to estate planning for clients with millions of dollars in assets, we have the experience and legal knowledge you need to keep your legacy secure. Read on to get answers to some of the most common elder law questions:

What Are The Most Common Issues That Elder Law Addresses?

Elder law primarily addresses issues affecting the aging population. These typically include estate planning, asset protection, guardianship, powers of attorney, healthcare planning, and long-term care financing. Elder law also covers Medicare and Medicaid eligibility and appeals, retirement benefits issues, and elder abuse and fraud protection. Each of these areas focuses on protecting the elder’s legal rights and ensuring their well-being and financial security as they age.

How Can Elder Law Help With Estate Planning?

Elder law plays a crucial role in estate planning by helping individuals prepare for the future management and disposition of their estate. This includes drafting wills, setting up trusts, arranging for the care and protection of minors and dependents, and minimizing tax implications. By addressing these elements, elder law ensures that an individual’s assets are distributed according to their wishes and that their loved ones are provided for in their absence.

What Is The Difference Between A Power Of Attorney And A Guardian?

A power of attorney is a legal document that grants one person or entity the authority to act on behalf of another in financial or medical decisions. This arrangement can be set to take effect immediately or can be activated by certain conditions, such as the principal’s incapacity.

In contrast, a guardian is someone legally appointed by a court to manage the personal and/or financial affairs of another, known as the ward, who is unable to manage their own affairs due to reasons such as age, incapacity, or disability.

What Are The Implications Of Transferring Assets To Family Members?

Transferring assets to family members can have significant legal and financial implications, especially concerning Medicaid eligibility and tax consequences. For example, Medicaid has a look-back period in which they examine asset transfers made within five years prior to applying for Medicaid. If assets were transferred for less than fair market value, it might delay the individual’s eligibility for Medicaid benefits.

How Do I Find An Elder Law Lawyer In Tennessee?

It’s important to choose a Knoxville elder law attorney who has experience with the specific issues you are facing and who you feel comfortable working with on personal and potentially sensitive matters. You can start by seeking referrals from friends, family, or other professionals such as financial advisors or healthcare providers. Professional directories and the Tennessee Bar Association can also provide listings of lawyers specializing in elder law.

Knoxville Elder Law Glossary

At Carpenter & Lewis PLLC, our Knoxville, TN elder law lawyer focuses on issues affecting older adults. Since 1989, our team has assisted clients with healthcare, financial planning and their protection of rights and assets. Below are five key legal terms commonly associated with elder law, along with definitions that can help individuals understand their legal rights and responsibilities in later life.

Medicaid Eligibility

Medicaid eligibility refers to the criteria that must be met to qualify for Medicaid assistance, a government program that provides healthcare to low-income individuals. For our trusted Knoxville elder law lawyer, understanding these guidelines is essential when helping seniors who may need long-term care, such as in a nursing home.. Medicaid eligibility involves a thorough review of income, assets, and medical needs, which can vary by state. Our attorneys help navigate these rules to ensure that seniors qualify for the benefits they need while protecting their wealth.

Elder Abuse

Elder abuse encompasses the mistreatment of older adults, which can take various forms including physical, emotional, sexual, or financial abuse. Legal protections exist to safeguard seniors from this type of mistreatment, often occurring in nursing homes or under the care of family members. Our Knoxville elder law lawyer plays a vital role in identifying signs of abuse and helping victims secure legal remedies. This can include seeking restraining orders, initiating guardianship proceedings, or pursuing criminal charges against perpetrators.

Long-Term Care Planning

Long-term care planning is the process of preparing for future medical and personal care needs as individuals age. This includes deciding how to pay for services such as in-home care, assisted living, or nursing homes. Our elder law attorneys assist in navigating insurance options, Medicaid, and other financial instruments to create a comprehensive plan. The goal is to minimize financial strain and ensure the individual receives the best possible care in their later years, while also protecting assets for heirs.

Estate Planning

Estate planning is the process of organizing one’s financial affairs to determine how assets will be distributed after death, as well as how decisions will be made if one becomes incapacitated. For seniors, this often involves creating wills, setting up trusts, and designating powers of attorney for healthcare and finances. Our legal professionals ensure that these documents reflect the person’s wishes and comply with state laws. They also provide strategies to minimize estate taxes, avoid probate, and ensure smooth transitions for family members.

Trusts

A trust is a legal arrangement where one person (the trustor) transfers their assets to a trustee, who manages and distributes those assets according to the terms of the trust for the benefit of designated beneficiaries. Trusts are commonly used in elder law as a tool to avoid probate, protect assets from long-term care costs, and ensure that the elderly individual’s wishes are carried out. There are various types of trusts, including revocable living trusts, irrevocable trusts, and special needs trusts, each serving a different purpose depending on the individual’s goals.

Ensuring Your Legal Needs Are Met

If you or a loved one needs guidance on any aspect of elder law, don’t hesitate to reach out to the team at Carpenter & Lewis PLLC. Get in touch with us today, and see how a Knoxville, TN elder law lawyer from our office can help.

Carpenter & Lewis Probate Attorney Consultation:

For a consultation with one of the probate attorneys at Carpenter & Lewis, please call (865) 690-4997 or you may prefer to send an e-mail to: [email protected]. Consultations are by appointment only.

Request A Consultation

Client Review

“We own several businesses and have had the pleasure of working with Stephen and his team for over 9 years now. He always comes through in a pinch. They have assisted us with leases, estate planning, company formations and even landlord issues. I highly recommend them for all your business attorney needs!”

Mary Ellen Nichols

Schedule Your Appointment

10413 Kingston Pike, Suite 200

Knoxville, Tennessee 37922

New Clients: (865) 509-9600

Existing Clients: (865) 690-4997

Facsimile: (865) 690-4790

10413 Kingston Pike, Suite 200 Knoxville, Tennessee 37922

Also Serving: Farragut TN

New Clients: (865) 509-9600

Existing Clients: (865) 690-4997

Facsimile: (865) 690-4790

Community Property Trust Lawyer Knoxville TN

Probate Lawyer Knoxville TN

Probate Lawyer Madisonville TN

Probate Lawyer Maryville TN

Business Sale Lawyer Knoxville TN

Business Purchase Lawyer Knoxville TN

Business Contract Lawyer Knoxville TN

Business Transactions Lawyer Knoxville TN

Small Business Lawyer Knoxville TN

Business Formation Lawyer Alcoa TN

Business Purchase Lawyer Lenoir City TN

Business Sale Lawyer Alcoa TN

Business Sale Lawyer Lenoir City TN

Business Contract Lawyer Seymour TN

Living Trust Lawyer Seymour TN