Estate Planning Lawyer Maryville, TN

The Importance Of An Estate Plan

If you would like help creating an estate plan that fits your circumstances and wishes, then contact our Maryville, TN estate planning lawyer as soon as you can. For over 30 years, our legal team at Carpenter & Lewis PLLC has helped individuals and their families find peace of mind. Helping our clients plan for the future and protect their loved ones has been our goal from the very beginning. Formalize an estate plan that works for you and your family by scheduling a consultation today.

Estate Planning Basics

Estate planning involves a review of your needs, both current and future. Most people think of estate planning as outlining how they want their assets to be distributed after they pass away. While this is true, it is just one small component of the entire estate planning process.

By having an estate plan, you will have answers to things such as who will make decisions for you if you suddenly become incapacitated or ill, who will care for your children in the event of your death, who will be responsible for administering your state, and who will receive your assets after you pass on. Having an estate plan allows you to remain in control over events that have yet to happen.

Furthermore, estate planning enables you to accomplish goals such as protecting assets from creditors, limiting the impact of estate taxes, eliminating the need for probate, controlling your beneficiaries access to funds, planning for the future of your business, and preparing for possible long-term care needs.

In Tennessee, effective estate planning not only provides peace of mind but also minimizes potential conflicts among beneficiaries and reduces estate taxes. Our experienced Tennessee estate planning attorney can work with you to develop a personalized estate plan suiting your needs, obligations, and future goals.

Estate planning involves making arrangements for the management and disposal of your estate during your life and after you pass. This includes drafting wills, setting up trusts, designating powers of attorney, and planning for potential incapacity. The goal is to distribute your assets according to your wishes, reduce taxes, and provide for your loved ones. To have our estate planning attorney guide you through the estate planning process, contact us today.

Estate Planning Documents

Estate planning is an essential process for everyone, not just for those who are reaching retirement age. Estate planning can be helpful for families and individuals alike, in various stages of life. Having an estate plan offers certainty for yourself and your closest loved ones.

There are many documents that may be included in your estate plan. Everyone’s plan should be geared towards their specific needs and circumstances, but there are some common documents that tend to be in most plans. These documents can include the last will and testament, trusts, advanced directive, beneficiaries, power of attorney, and more.

When preparing to create your estate plan it helps to know what your assets are, and who you would like your beneficiaries to be. Beneficiaries are people and/or charity organizations who you would like to inherit certain assets after your departure. If you have questions about these documents, please don’t hesitate to reach out to our team to get started. Our lawyers can help you craft a plan that works for you and your goals and help you avoid common mistakes in the estate planning process.

Wills

A will allows you to specify how your assets should be distributed, name an executor to manage your estate, and appoint guardians for minor children. In Tennessee, a will must be written, signed by the testator (the person creating the will), and witnessed by at least two people who do not stand to inherit under the will. Without a valid will, your estate will be distributed according to Tennessee’s intestacy laws, which may not align with your wishes.

Trusts

Trusts are versatile estate planning tools that can offer significant benefits. In Tennessee, there are several types of trusts:

- Revocable Living Trusts: These allow you to maintain control over your assets during your lifetime and specify how they should be distributed after your death.

- Irrevocable Trusts: Once established, these cannot be changed. They offer tax benefits and protection from creditors.

- Special Needs Trusts: These are designed to provide for a disabled beneficiary without disqualifying them from government benefits.

Powers Of Attorney

A power of attorney (POA) is a legal document that grants someone else the authority to make decisions on your behalf. In Tennessee, there are several types of POAs:

- Durable Power of Attorney: This remains in effect if you become incapacitated.

- Healthcare Power of Attorney: This allows someone to make medical decisions for you if you are unable to do so.

- Financial Power of Attorney: This designates someone to handle your financial affairs.

Living Wills And Advance Directives

A living will, also known as an advance directive, outlines your wishes regarding medical treatment in the event you become incapacitated. This document can specify your preferences for life-sustaining treatments and other medical care, so that your wishes are followed even if you cannot communicate them.

Essential Considerations For Digital Asset Planning

From social media accounts to cryptocurrency, digital assets require careful planning so that they are properly managed and passed on. When planning for the future, many people forget about their digital property. Our experienced estate planning attorney can review your assets and incorporate them into your overall estate plan.

Here are seven essential considerations that the Carpenter & Lewis PLLC legal team employs for digital asset estate planning:

- Identify And Inventory Your Digital Assets

The first step in digital asset estate planning is identifying and inventorying all your digital assets. This includes online banking accounts, social media profiles, email accounts, digital photos and videos, cryptocurrencies, and online subscriptions and memberships.

Create a comprehensive list, including usernames, passwords, and security questions. This inventory will serve as a roadmap for your executor or loved ones to manage and distribute your digital assets after your passing.

- Understand The Terms of Service Agreements

Different digital platforms have varying terms of service agreements, which affects what happens to your digital assets after you die. For example, some social media platforms allow for memorialization or transfer of accounts, while others may automatically delete the account. It’s important to understand these terms and plan accordingly. Documenting your wishes in accordance with these agreements confirms that your digital assets are handled as you desire.

- Designate A Digital Executor

Just as you would appoint an executor for your physical estate, it’s important to designate a digital executor who will manage your digital assets. This person should be tech-savvy and trustworthy. Give them have access to your digital asset inventory and help them to understand your wishes regarding each asset. Including this designation in your will or trust provides legal authority for your digital executor to act on your behalf.

- Securely Store Access Information

It is essential to securely store the access information for your digital assets. Consider using a password manager to record and share access credentials with your digital executor. Additionally, include instructions on how to access the password manager itself. Secure storage options, such as encrypted digital files or physical copies in a safe, help protect this sensitive information from unauthorized access.

- Plan For Digital Financial Assets

Digital financial assets, such as cryptocurrencies and online investment accounts, require special consideration. Your digital executor must understand how to access and manage these assets. This may involve providing private keys for cryptocurrency wallets or login information for investment platforms. Given the potential value of these assets, clear instructions and secure access are essential.

- Address Intellectual Property Rights

If you create digital content, such as blogs, videos, or music, address the intellectual property rights in your estate plan. Specify who will own and manage these creations after your death. Consider any ongoing revenue generated from these assets, such as ad revenue from a YouTube channel or royalties from published work, and detail their distribution according to your wishes.

Types Of Estate Planning Services Our Lawyer Offers

Here are some of the key types of estate planning services our Maryville, TN estate planning lawyer offers.

Wills

A will is a foundational estate planning document. It allows you to specify how your assets should be distributed after your death and who should serve as the guardian of your minor children. Without a valid will, state laws determine how your property is divided, which may not reflect your wishes. We help clients draft clear, legally sound wills that reflect their personal and financial goals.

Trusts

Trusts are flexible tools that can help manage and protect assets both during your lifetime and after your passing. Living trusts can help assets transfer to beneficiaries more efficiently and may reduce the need for probate. Other types of trusts can provide asset protection, support a loved one with special needs, or manage funds for minor children. We work with clients to determine which trust structures best meet their needs.

Powers Of Attorney

A power of attorney allows you to appoint someone you trust to handle financial or legal matters if you become unable to do so. This document can be essential in situations involving illness, injury, or age-related incapacity. Without it, loved ones may need to go through a court process to gain authority. Our Maryville estate planning lawyer assists clients in creating durable powers of attorney tailored to their circumstances.

Healthcare Directives

Healthcare directives, sometimes called living wills or advance directives, outline your medical preferences if you are unable to communicate them yourself. These documents may address life-sustaining treatment, end-of-life care, and other important decisions. We help clients put their wishes in writing and designate a healthcare proxy to make medical decisions on their behalf.

Beneficiary Designations

Certain assets, such as life insurance policies, retirement accounts, and payable-on-death accounts, pass directly to named beneficiaries. Keeping these designations up to date is a critical part of an estate plan. Our firm reviews beneficiary forms to ensure they align with your overall plan and current life circumstances.

Guardianship Planning

Parents of minor children often want to ensure their children are cared for by someone they trust if something happens to them. Estate planning allows you to name a guardian and provide financial resources for your child’s care. We guide parents through these decisions with care and attention to detail.

Probate And Estate Administration Planning

Proper planning can make the probate and estate administration process smoother for loved ones. By organizing documents, clarifying wishes, and using tools like trusts, you can reduce confusion and delays. We help clients structure their plans with these goals in mind.

Estate planning is an ongoing process that should evolve as your life changes. Our Maryville estate planning lawyer is committed to helping clients create thoughtful, personalized plans that provide clarity, protection, and confidence about the future. At Carpenter & Lewis PLLC, we are here to help you. Founded in 1989 by Stephen L. Carpenter, our firm stands out by focusing solely on estate and transactional law, delivering precise solutions tailored to both individuals and businesses.

Maryville Estate Planning Infographic

Maryville Estate Planning Statistics

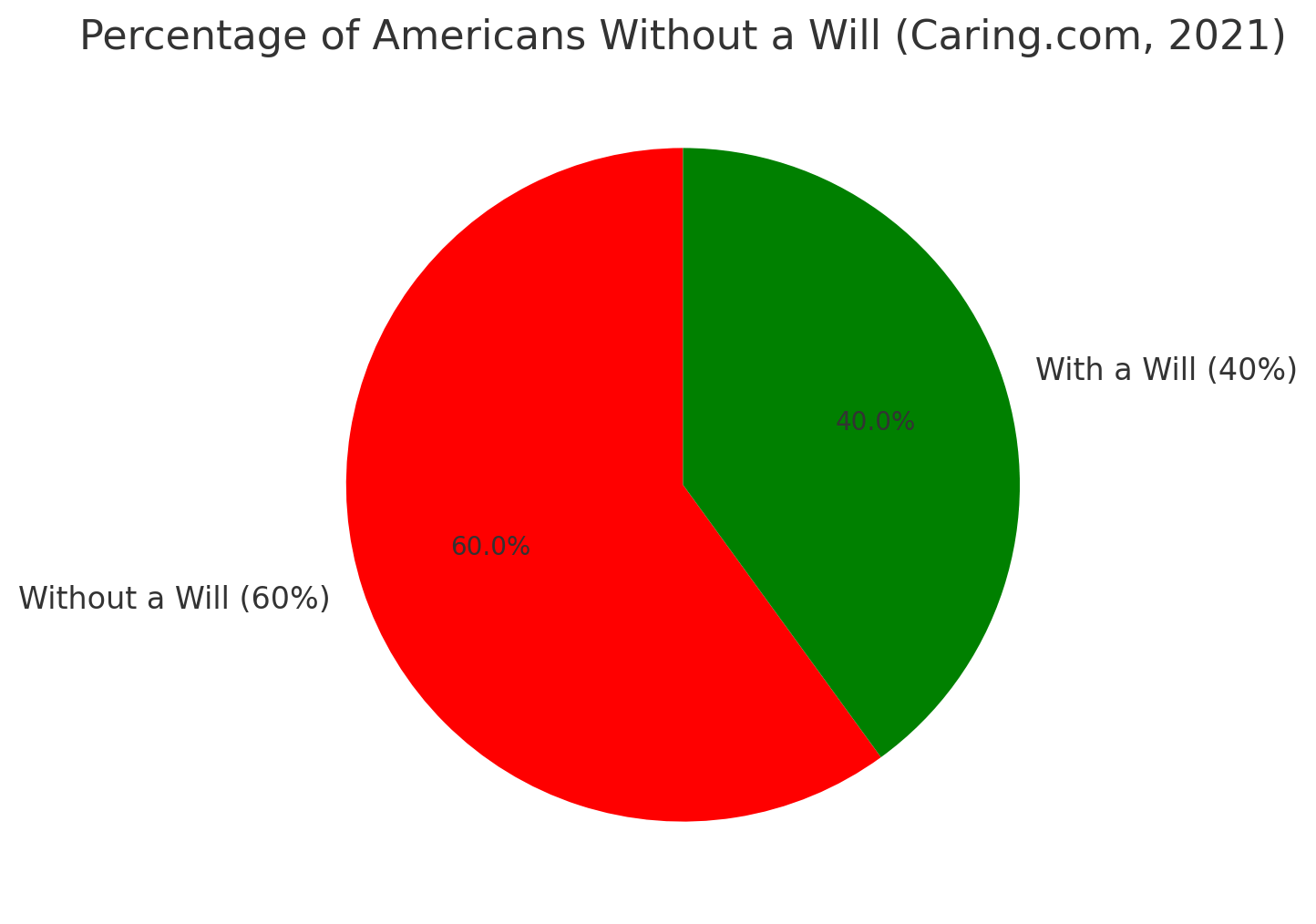

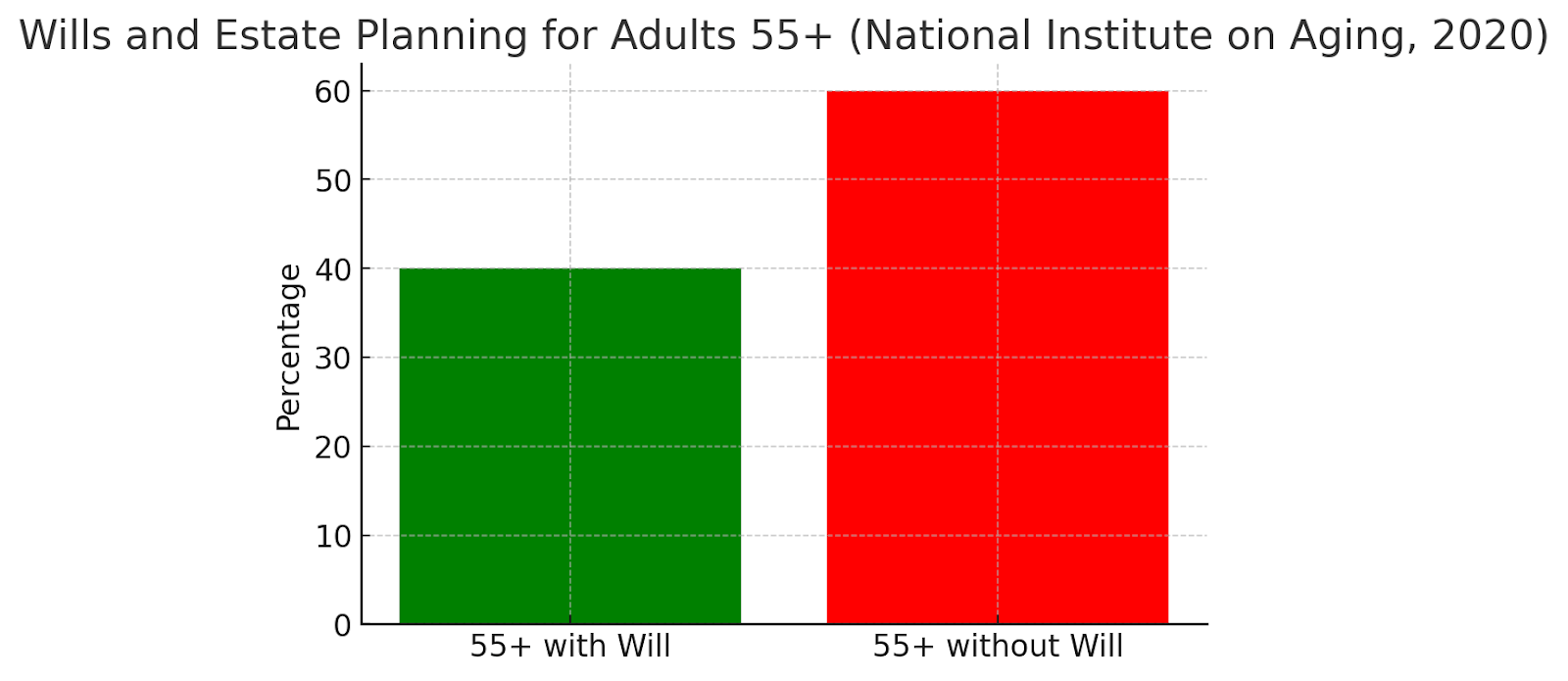

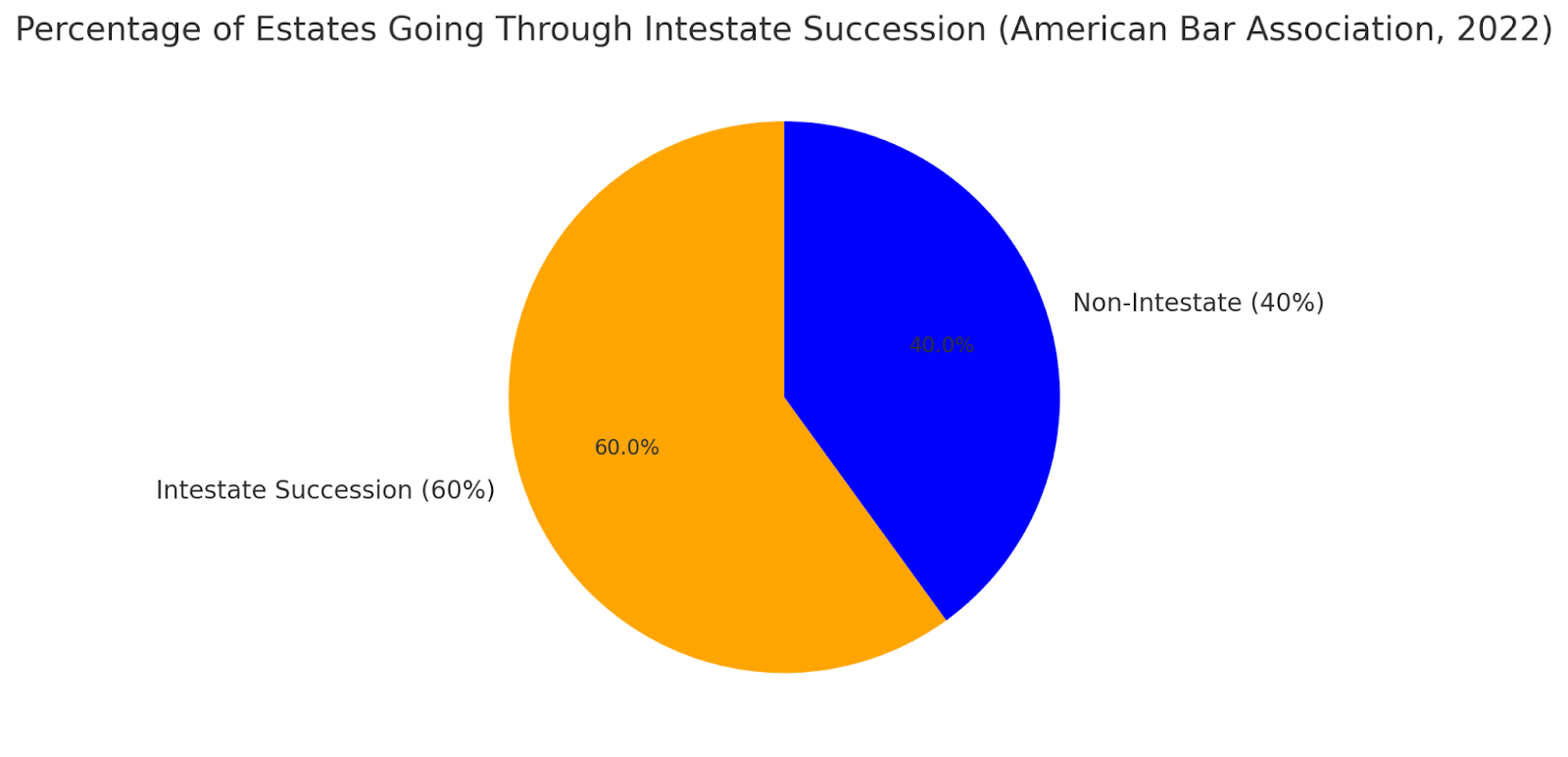

Estate planning is a vital step in making sure that your assets are distributed according to your wishes after death. Here are three important statistics that highlight the significance of estate planning:

- Percentage Of Americans Without a Will: According to a survey by Caring.com, 60% of Americans do not have a will. This means that a majority of individuals are not adequately preparing for the distribution of their assets, potentially causing complications for their families.

- Estate Planning For Older Adults: A 2020 study by the National Institute on Aging revealed that only 40% of adults aged 55 and older have a will in place. Estate planning becomes increasingly important as people age, particularly for healthcare decisions and asset distribution.

- Intestate Succession In The U.S.: The American Bar Association reports that approximately 60% of estates in the United States go through intestate succession because the deceased did not have a valid will. This can lead to legal disputes, delays, and family conflicts.

Estate Planning FAQs

Our Maryville estate planning lawyer can help you protect your legacy. At Carpenter & Lewis PLLC, we have over 30 years of experience helping our clients with wills, trusts, and estate planning for estates worth millions of dollars. No matter your net worth, we’re here to help. Read on to get some much-needed answers about estate planning, and contact us today to get started.

What Happens If I Die Without A Will?

If you pass away without a will, your estate is considered intestate. In Tennessee, this means your assets will be distributed according to state laws, which may not reflect your personal wishes. Typically, the court will divide your estate among your closest relatives, such as your spouse, children, or parents. This process can be lengthy, stressful, and might lead to disputes among your loved ones. Having a will in place allows you to decide who receives your assets, and it can significantly simplify the legal process for your heirs.

What Is The Order Of Next Of Kin In Tennessee?

In Tennessee, the order of next of kin is determined by state succession laws when someone dies intestate. The estate first goes to the surviving spouse and children. If there are no spouse or children, the estate is distributed to the decedent’s parents, then siblings, and so forth. This hierarchical order underscores the importance of estate planning so that your assets are distributed according to your specific desires rather than a predefined legal formula.

At What Age Should I Start Thinking About Estate Planning?

There is no specific age to start estate planning, but it’s wise to begin once you have any significant assets, responsibilities, or dependents. This could be when you buy your first home, have children, or acquire significant assets like investments or a business. Early estate planning is beneficial because it not only secures your financial future but also provides peace of mind knowing that your loved ones will be taken care of according to your wishes.

How Often Should I Update My Estate Planning Documents?

It’s advisable to review and possibly update your estate planning documents at least every three to five years or after significant life events. These events can include marriage, divorce, the birth of a child, the death of a family member, or significant changes in your financial situation. Regular updates allows your estate plan to reflect your current circumstances and wishes.

How Do I Choose The Right Executor For My Estate?

Choosing the right executor is important as this person will be responsible for managing your estate according to your wishes after you pass away. Consider selecting someone who is responsible, organized, and trustworthy. It’s often beneficial to choose someone who is also impartial and has a good understanding of your family dynamics to handle potential conflicts effectively. Our estate planning attorney can help you consider your options.

Maryville Estate Planning Glossary

Planning for the future can feel overwhelming, especially when it comes to legal documents and decisions about your estate. At Carpenter & Lewis PLLC, we’ve spent more than thirty years helping individuals and families in Maryville, Tennessee, protect what matters most. From asset distribution to healthcare decisions, our experienced estate planning lawyer is here to guide you through the process with clarity. Below are five important legal terms you’ll likely encounter during estate planning—each with a brief explanation to help you better understand the process and your options.

Executor

An executor is a person designated in a will to handle the distribution of assets and the settlement of a deceased person’s estate. This individual is responsible for paying any outstanding debts, filing tax returns, and confirming the terms of the will are followed. An executor must act in good faith and may need to go through the probate process to carry out their duties. If no executor is named, the court will appoint one.

Beneficiary

A beneficiary is an individual or entity designated to receive assets from an estate, trust, life insurance policy, or retirement account. In estate planning, clearly naming your beneficiaries helps ensure your assets are distributed according to your wishes. Our Maryville estate planning lawyer can help you structure beneficiary designations to minimize disputes and avoid unnecessary probate complications. It’s important to regularly review and update your beneficiary designations, especially after major life changes such as marriage, divorce, or the birth of a child.

Probate

Probate is the legal process by which a court validates a will and administers the deceased’s estate. It involves gathering the deceased’s assets, paying any debts or taxes, and distributing the remaining assets to beneficiaries. The process can be lengthy and costly, especially if the will is contested or if complex assets are involved. Avoiding probate is often a key consideration in estate planning, and this can be achieved through tools like trusts.

Will Contest

A will contest occurs when someone challenges the validity of a will during the probate process. Common reasons for contesting a will include claims of undue influence, lack of mental capacity, fraud, or improper execution. Our Maryville estate planning attorney can help you draft a will that meets all legal requirements and reduces the likelihood of disputes. We also assist clients involved in contested probate cases, whether they are defending a valid will or raising legitimate concerns about its authenticity.

Codicil

Contact Our Estate Lawyer Today

At Carpenter & Lewis PLLC, we are dedicated to helping you manage estate planning decisions with confidence and ease. If you have questions or need legal guidance tailored to your unique situation, don’t hesitate to reach out to us. Founding attorney, Stephen L. Carpenter brings over three decades of legal experience in wills, estate planning, trusts, and small business law. Contact our firm today, and see how our Maryville estate planning lawyer can help.

Request A Consultation

Client Review

“We own several businesses and have had the pleasure of working with Stephen and his team for over 9 years now. He always comes through in a pinch. They have assisted us with leases, estate planning, company formations and even landlord issues. I highly recommend them for all your business attorney needs!”

Mary Ellen Nichols

Schedule Your Appointment

10413 Kingston Pike, Suite 200

Knoxville, Tennessee 37922

New Clients: (865) 509-9600

Existing Clients: (865) 690-4997

Facsimile: (865) 690-4790

10413 Kingston Pike, Suite 200 Knoxville, Tennessee 37922

Also Serving: Farragut TN

New Clients: (865) 509-9600

Existing Clients: (865) 690-4997

Facsimile: (865) 690-4790

Community Property Trust Lawyer Knoxville TN

Probate Lawyer Knoxville TN

Probate Lawyer Madisonville TN

Probate Lawyer Maryville TN

Business Sale Lawyer Knoxville TN

Business Purchase Lawyer Knoxville TN

Business Contract Lawyer Knoxville TN

Business Transactions Lawyer Knoxville TN

Small Business Lawyer Knoxville TN

Business Formation Lawyer Alcoa TN

Business Purchase Lawyer Lenoir City TN

Business Sale Lawyer Alcoa TN

Business Sale Lawyer Lenoir City TN

Business Contract Lawyer Seymour TN

Living Trust Lawyer Seymour TN